Answer. Stimulus checks are not eligible for double endorsement. Therefore, they cannot be signed over to another person or deposited into a bank account not owned by the recipient of the check.

Keeping this in consideration, Does a joint account need both signatures?

A joint account is a bank or brokerage account shared by two or more individuals. Joint account holders have equal access to funds but also share equal responsibility for any fees or charges incurred. Transactions conducted through a joint account may require the signature of all parties or just one.

Secondly Can I deposit my boyfriends stimulus check into my account? “Stimulus checks are not eligible for double endorsement,” a representative told a customer in a March 16 Q&A. “Therefore, they cannot be signed over to another person or deposited into a bank account not owned by the recipient of the check.”

Can I deposit my sons check into my account?

Parents are allowed to deposit their children’s checks into their own personal bank accounts. To do this, parents must first print their child’s name on the back of the check and then write the word “minor” in parentheses; you also could use a hyphen instead of parentheses.

Table of Contents

What are the disadvantages of joint account?

However, combining your finances into a joint account can have its disadvantages as well. They include: You or your spouse may feel confined without access to “your own money”. With a joint account there is a lack of financial privacy, since you both have your finances exposed to one another.

Can you deposit a joint check into a joint account with one signature?

Not only can you deposit a check to just one spouse into a joint account, but you have a few options for doing so. … The bank will accept the check because Spouse A is an equal owner on the account into which the check is being deposited. But what if Spouse A isn’t available to endorse the check? That’s okay, too.

How do I cash a stimulus check for an inmate?

You will have to endorse it over to them. Take your check to a bank/credit union and open a checking account with it. The bank/credit union will hold your funds for up to 5 days to make sure it clears. Then you can write a check for some of the money to use as cash.

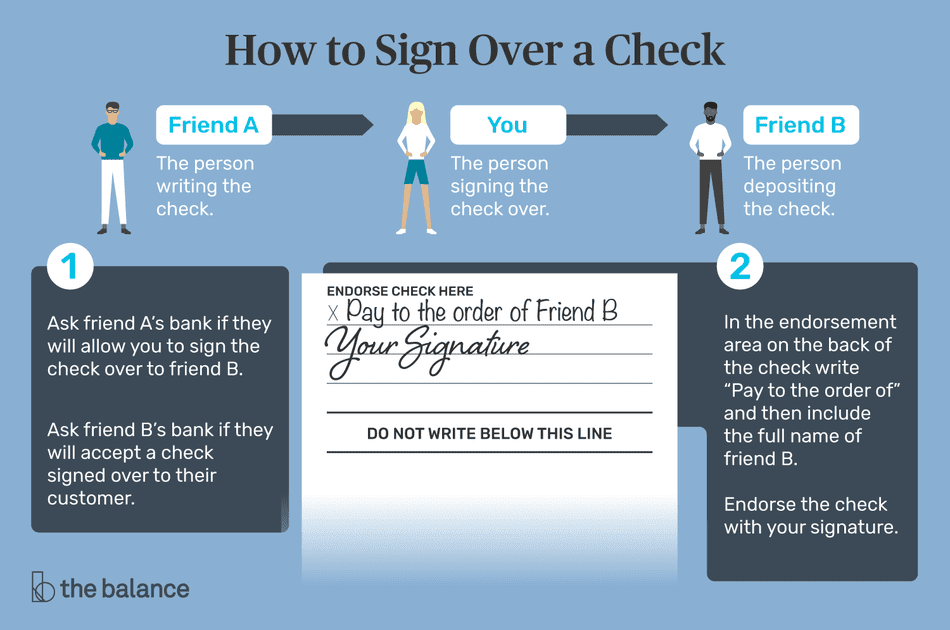

How can I cash a check that’s not in my name?

This would be done by having the payee endorse the check (sign the back) and below that write “PAY TO THE ORDER OF JOHN SMITH“, and then John Smith can endorse and then cash or deposit the check.

Can I endorse my stimulus check to someone else to cash at Walmart?

The short answer is no! The check requires your endorsement, and you will need to show your government-issued photo ID. That means you can’t send someone else to cash a check for you. This may amount to attempted fraud.

Can you deposit someone else’s check in your account RBC?

Yes, here’s the scenario. I bank with RBC and wife banks with TD. We’ve deposited each other’s health benefit remimbursement cheques on several occasions and they all went through (ATM, teller and mobile deposit).

Can I deposit a check with my name and someone else’s name on it?

If the check is issued to two people, such as John and Jane Doe, the bank or credit union generally can require that the check be signed by both of them before it can be cashed or deposited. If the check is issued to John or Jane Doe, generally either person can cash or deposit the check.

Can I empty my bank account before divorce?

That means technically, either one can empty that account any time they wish. However, doing so just before or during a divorce is going to have consequences because the contents of that account will almost certainly be considered marital property. That means it will be equitable division in the divorce settlement.

Why you shouldn’t have a joint account?

A joint account can also be problematic if the relationship ends. If the couple decides to part ways, the funds in a joint account can be messy to separate. Each spouse has every right to withdraw money and close the account without the consent of the other, and one party can easily leave the other penniless.

Can unmarried couples open a joint bank account?

Joint Bank Accounts

You should have no problem opening a joint checking or banking account under both your names. … Many unmarried couples have peacefully maintained joint bank accounts for years. But a joint account is still a risk. Each person has the right to spend all the money.

What if a check is made out to two names?

If the check is issued to two people, such as John and Jane Doe, the bank or credit union generally can require that the check be signed by both of them before it can be cashed or deposited. If the check is issued to John or Jane Doe, generally either person can cash or deposit the check.

Can a joint account holder endorse a check?

Yes. Since you and your wife have a joint account, that means technically you each own all of the money in the account. For the endorsement on the back, you can write “for deposit only to the within named payee”. It’s easier to just ask the teller to stamp it though.

How do I endorse a joint check?

Thus a check made out to “Jane Doe and John Doe,” “Jane Doe & John Doe,” or “Jane Doe + John Doe” would call for a joint endorsement. On the other hand, if the payee names on the check are separated by a simple comma, such as “Jane Doe, John Doe,” then either party could endorse the check.

What happens if I don’t cash my stimulus check?

You’ll generally receive a response about six weeks after the IRS receives your request for a payment trace (there could be delays due to limited IRS staffing). They will process your claim for a missing payment in one of two ways. If the check was not cashed, the IRS will issue you a new one.

Where can you cash a stimulus check without ID?

Cash it at the issuing bank (this is the bank name that is pre-printed on the check) Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.) Cash the check at a check-cashing store. Deposit at an ATM onto a pre-paid card account or checkless debit card account.

Can I Mobile Deposit my stimulus check?

For many taxpayers, the stimulus payments will be deposited directly into their bank account. … You can use your bank’s mobile app or website to handle most common banking tasks like depositing checks, paying bills, sending money to friends, and locking and unlocking a credit or debit card.

What happens if you deposit someone else’s check?

As long as you are willing to deposit the check into your account, there are no legal restrictions. The banks will accept the check if it has a “For Deposit Only” mark. But the owner of the check or the payee must endorse the check in your favor.

How can I cash a stimulus check without ID?

How to Cash a Check without an ID

- Signing it over to another individual.

- Using ATM check cashing if it’s offered by your bank.

- Depositing it into your own account using a bank ATM.

Can a POA cash a stimulus check?

It is up to the bank. You can’t force them to accept your POA. Or if they do, they might not cash it, but require it to be deposited into his account.

Will Walmart cash a signed over check?

We make it simple for you to cash your check while you’re at Walmart. All you need to do is present your endorsed check to the cashier at our Money Service Center or Customer Service Desk, along with valid identification, and pay the required fee.

Where can I cash my stimulus check without ID?

Cash it at the issuing bank (this is the bank name that is pre-printed on the check) Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.) Cash the check at a check-cashing store. Deposit at an ATM onto a pre-paid card account or checkless debit card account.