Identity theft affects about 1 in 20 American each year. According to Javelin’s 2020 Identity Fraud Survey, 13 million consumers in the U.S. were affected by identity fraud in 2019 with total fraud losses of nearly $17 billion.

Keeping this in consideration, What should you do if you suspect identity theft?

Report Identity Theft. Report identity (ID) theft to the Federal Trade Commission (FTC) online at IdentityTheft.gov or by phone at 1-877-438-4338. The FTC will collect the details of your situation.

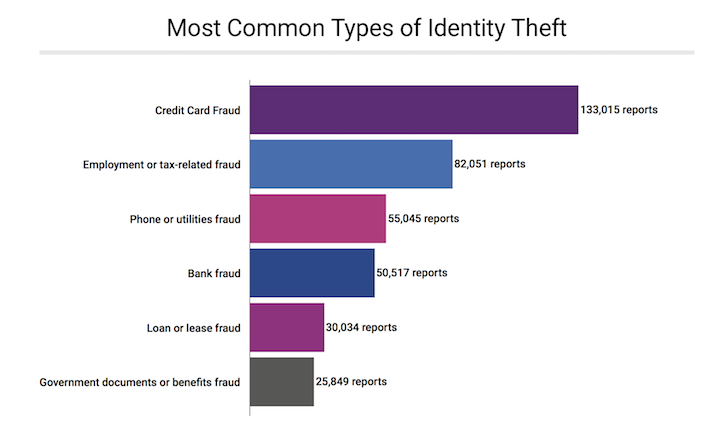

Secondly What is the most common form of identity theft? Financial identity theft is by far the most common type of identity theft. In 2014, identity thieves stole $16 billion from 12.7 million identity fraud victims, according to Javelin Strategy & Research.

Who is most likely to be a victim of identity theft?

U.S. residents age 16 or older, were victims of one or more incidents of identity theft in 2014 (figure 1). This was similar to findings in 2012. Among identity theft victims, existing bank (38%) or credit card (42%) accounts were the most common types of misused information.

Table of Contents

What are the first signs of identity theft?

10 Warning Signs of Identity Theft

- An unfamiliar loan or credit account on your credit report. …

- An inexplicable denial of credit. …

- Bills for accounts you know nothing about. …

- An unexpected drop in your credit score. …

- Collections agency calls for overdue accounts you know nothing about.

How long does it take to investigate identity theft?

On average, it can take 100 to 200 hours over six months to undo identity theft. The recovery process may involve working with the three major credit bureaus to request a fraud alert; reviewing your credit reports to pinpoint fraudulent activity; and reporting the theft.

What do hackers do with your stolen identity?

Your info could be used to open credit cards or take out loans. If hackers have your Social Security number, name, birthdate and address, they can open credit cards or apply for loans in your name.

What are the 4 types of identity theft?

The four types of identity theft include medical, criminal, financial and child identity theft.

What is needed to steal my identity?

Identity theft begins when someone takes your personally identifiable information such as your name, Social Security Number, date of birth, your mother’s maiden name, and your address to use it, without your knowledge or permission, for their personal financial gain.

Which is the most common age group for victims of identity theft?

In 2020, the most targeted age group for identity theft were 30 to 39 year olds, among whom 306,090 cases were reported to the Federal Trade Commission (FTC) in the United States. The second most targeted age group were those aged 40 to 49, with 302,678 cases of identity theft reported.

What are four types of identity theft crimes?

The information is captured in a wide gamut of methods from sifting through someone’s trash to accessing databases. The four types of identity theft include medical, criminal, financial and child identity theft.

How fast does identity theft happen?

On average, it can take 100 to 200 hours over six months to undo identity theft. The recovery process may involve working with the three major credit bureaus to request a fraud alert; reviewing your credit reports to pinpoint fraudulent activity; and reporting the theft.

What are some warning signs of identity theft?

Here are ten red flags that indicate someone has stolen your identity.

- You receive unexpected credit cards or account statements. …

- You’re denied credit for no apparent reason. …

- You receive calls or letters from unknown debt collectors. …

- Your bills and bank statements don’t arrive in the mail.

What are 3 things you should do if you learn your identity has been stolen or compromised?

- File a claim with your identity theft insurance, if applicable. …

- Notify companies of your stolen identity. …

- File a report with the FTC. …

- Contact your local police department. …

- Place a fraud alert on your credit reports. …

- Freeze your credit. …

- Sign up for a credit monitoring service, if offered.

What do identity thieves look for?

Any of these pieces of information are fair game for identity thieves, though some are more valuable than others: SSN, date of birth, credit card numbers, driver’s license number, Social Security card, passwords and usernames, rewards account numbers, and more.

Can you fully recover from identity theft?

On average, it can take between 100 and 200 hours and six months to fix. But in some cases, it can take thousands of hours and years to resolve fully. Several key factors determine the length of the recovery process, but before we review those, let’s look at the steps involved in resolving identity theft.

Does identity theft ruin your life?

Damaged credit: If an identity thief steals your Social Security number (SSN), opens new accounts in your name and never pays, it could ruin your credit history. Not only can this impact your ability to get credit, but it can also hurt your job prospects and increase your auto and homeowners insurance premiums.

How much does it cost to recover from identity theft?

The average loss for a victim of identity theft is $1,100, according to the Javelin study.

Can someone steal your identity with just your name?

This is commonly referred to as personally identifiable information, or PII. When such information is linked to your name, it gives the thief easy access to your identity. Armed with just your name and your Social Security number, a thief can not only access your accounts but also obtain credit in your name.

What can hackers do with your birthday?

A professional hacker who has access to your birth-date can easily collect more information about you (including zip code, SSN numbers and maiden’s name) from these various sites and pile them up to cause you some serious damage. Such data can then be used to sign up for credit cards and even to apply for loans.

What are 2 warning signs that your identity may have been stolen?

9 warning signs of identity theft

- Your bank statement doesn’t look right or your checks bounce. …

- You see unfamiliar and unauthorized activity on your credit card or credit report. …

- Your bills are missing or you receive unfamiliar bills. …

- Your cellphone or another utility loses service.

Can someone steal my identity with the last four digits of my SSN?

Scammers can use different ways and means to steal your identity by using the last 4 digits of SSN and DOB. With this information in their hands, they can steal your money, create credit card accounts, take away your hard-earned benefits, and use your name for illegal transactions.

What increases the risk of identity theft?

#1 Risk Factor – Where You Live

Many companies like ID Analytics, Experian or IDT911 have analyzed the problem of identity theft and there findings indicate that if you live in certain areas of the country, the probability of being a victim of identity theft can be double or triple other areas.

How can you protect yourself from identity theft?

- 10 Ways To Protect Yourself From Identity Theft. …

- Destroy private records and statements. …

- Secure your mail. …

- Safeguard your Social Security number. …

- Don’t leave a paper trail. …

- Never let your credit card out of your sight. …

- Know who you’re dealing with. …

- Take your name off marketers’ hit lists.

Add comment