How to create an invoice: step-by-step

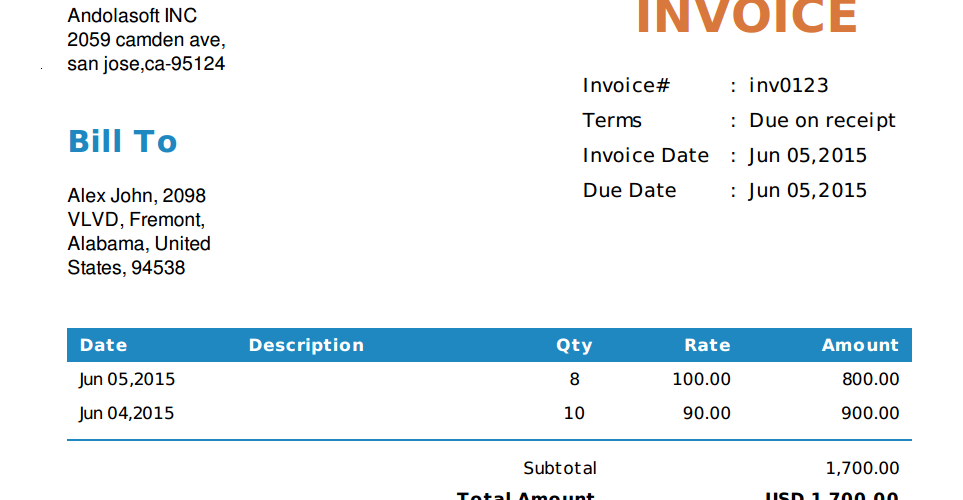

- Make your invoice look professional. The first step is to put your invoice together. …

- Clearly mark your invoice. …

- Add company name and information. …

- Write a description of the goods or services you’re charging for. …

- Don’t forget the dates. …

- Add up the money owed. …

- Mention payment terms.

Keeping this in consideration, How do I design an invoice?

How to Design an Invoice

- Design the Invoice Structure. Take time before diving into invoice design to plan out the structure of your invoice template. …

- Include Your Brand and Style. …

- Make the Information Readable. …

- Leave Room for Descriptions. …

- Make Deadlines and Payment Totals Stand Out. …

- Clearly State Payment Terms.

Secondly What is a basic invoice? An invoice is a document or bill sent by a provider of goods and services to their customer. Invoices itemize the transaction and include payment amounts and terms. … Invoices are often referred to as “sales invoices”, “bills”, or “statements”.

What is the best free invoice template?

Invoiceto.me is one the easiest and most straightforward invoice generator on the list. You can use it to send invoices for multiple types of work. All you have to do is put in details about the work and payments. You can then download the invoice as a PDF and have a professional-looking way to request payments.

Table of Contents

What is invoice with example?

The definition of an invoice is a detailed list of products or services showing the money owed for each item. An example of an invoice is a list of an artist’s contributions to a magazine for the month. noun.

Is receipt and invoice the same?

Whereas invoices are a request for payment, a receipt is proof of payment. It’s also important to remember that you’re legally required to include much more information on an invoice than you are on a receipt.

Is an invoice a bill?

An invoice and a bill are documents that convey the same information about the amount owing for the sale of products or services, but the term invoice is generally used by a business looking to collect money from its clients, whereas the term bill is used by the customer to refer to payments they owe suppliers for …

Does an invoice mean you’ve paid?

A receipt is different from an invoice in that an invoice is requesting payment for products or services received, whereas a receipt is proof that the services or products have already been paid for. An invoice comes before the payment has been made, while a receipt comes after the payment has been made.

What is the generic invoice template?

A generic invoice is a blank invoice template that is used by a business to ask for payment from a buyer for goods or services. A generic invoice format is used by a seller when they need a basic document that they can customize to the needs of their business.

Is invoice simple free?

The Invoice Simple App is a free invoice app for your first three invoices. Once you’ve seen how helpful it can be, you can gain access to a full Pro account.

Is invoice home free?

Invoice Home Pricing Overview

Invoice Home pricing starts at $5.00 per user, per month. There is a free version. Invoice Home offers a free trial.

How many types of invoices are there?

Learn about the three major types of invoices and when to use them to properly bill your customers. Invoices come in many shapes and sizes, and each one is designed for a specific purpose. Here are three of the most common types of invoices and what they’re used for.

What is a simple invoice?

Simple invoices save you time because they include just the basic accounting details you need to charge clients for your work. They’re streamlined documents that are easy to create and easy to understand.

Is tax invoice proof of payment?

The document serves as a proof of payment for finalising a sale. … It includes the list of goods or services, credit, taxes, discounts, the total amount paid, method of payment, etc. Since tax invoices are not receipts, businesses cannot use them directly to raise funds through bill discounting.

Is a receipt a tax invoice?

There’s a difference between receipts and tax invoices. A receipt is a document that shows proof of purchase, and allows you to return damaged or faulty goods to the business selling it. A tax invoice is a document shows the price of a purchase, as well as whether GST was collected.

What is the difference between a tax invoice and an invoice?

As such, the main difference between a standard invoice and a tax invoice is that the tax invoices include information about Goods & Services Tax (GST), whereas regular invoices don’t. … Both types of invoices are used for annual accounts and financial reports, while tax invoices are also needed to claim tax credits.

Is billing statement same as sales invoice?

An invoice serves to ask a buyer for payment. … A statement is meant to compel a buyer to make a payment on their account. The statement includes the most recent charges and notifies buyers of any amounts that are still owed on previous purchases.

How long do you legally have to pay an invoice?

Your right to be paid

Unless you agree a payment date, the customer must pay you within 30 days of getting your invoice or the goods or service.

Do I have to pay an invoice which is 2 years old?

The statute of limitations is 2 years for oral contracts and 4 years for written contracts. Thus, it is important to know if you had a written contract with them. Thus, right now as of right now the statute of limitations has not run.

What is the difference between and invoice and a statement?

An invoice is the legal or technical document for a bill. A statement on the other hand is an up-to-date report on what buyers still owe vendors on account. It is the status of a customer’s account at a certain point in time.

How do I generate an invoice number?

Best practices on numbering invoices

- Make every invoice number unique – you can start from any number you want.

- Assign sequential invoice numbers.

- Assign invoice numbers in chronological way.

- Structure invoice numbers any way you want, you may: use only numbers 001, 002, 003 etc., include Customer Name CN001, CN002, etc.

Is invoice a receipt?

What is a receipt? While an invoice is a request for payment, a receipt is the proof of payment. It is a document confirming that a customer received the goods or services they paid a business for — or, conversely, that the business was appropriately compensated for the goods or services they sold to a customer.

Does Google have an invoice template?

Create on-demand invoices with a Google Docs invoice template that is accessible from anywhere there is an internet service. Get paid promptly for all services rendered with this fully customizable invoice template.

Which is the best invoice App?

What’s the best invoicing app?

- QuickBooks. QuickBooks by Intuit is one of the most well-known invoicing and accounting apps for small businesses. …

- FreshBooks. …

- Invoicely. …

- InvoiceBerry. …

- KashFlow. …

- Zervant. …

- Tradify. …

- YourTradebase.

What’s the difference between an invoice and a receipt?

What’s the difference between an invoice and a receipt? … Whereas invoices are a request for payment, a receipt is proof of payment. It’s also important to remember that you’re legally required to include much more information on an invoice than you are on a receipt.

Add comment