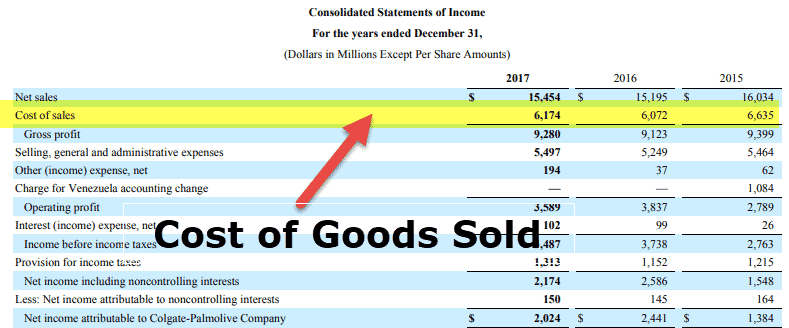

COGS/COS includes both direct labor costs, and any direct costs of materials used in producing or manufacturing a company’s products. … Cost of goods sold is subtracted from revenue to arrive at gross profit. In short, gross profit measures how well a company generates profit from their labor and direct materials.

Keeping this in consideration, What are COGS expenses?

Key Takeaways. Cost of goods sold (COGS) includes all of the costs and expenses directly related to the production of goods. COGS excludes indirect costs such as overhead and sales & marketing. COGS is deducted from revenues (sales) in order to calculate gross profit and gross margin.

Secondly What 5 items are included in cost of goods sold? COGS expenses include:

- The cost of products or raw materials, including freight or shipping charges;

- The direct labor costs of workers who produce the products;

- The cost of storing products the business sells;

- Factory overhead expenses.

What is included in COGS for a service company?

Cost of Goods Sold, (COGS), can also be referred to as cost of sales (COS), cost of revenue, or product cost, depending on if it is a product or service. It includes all the costs directly involved in producing a product or delivering a service. These costs can include labor, material, and shipping.

Table of Contents

What is the difference between COGS and expenses?

The difference between these two lines is that the cost of goods sold includes only the costs associated with the manufacturing of your sold products for the year while your expenses line includes all your other costs of running the business.

What is the formula for cost of goods sold?

Or, to put it another way, the formula for calculating COGS is: Starting inventory + purchases – ending inventory = cost of goods sold.

How do you calculate cost of goods sold on a balance sheet?

The cost of goods sold formula, also referred to as the COGS formula is: Beginning Inventory + New Purchases – Ending Inventory = Cost of Goods Sold. The beginning inventory is the inventory balance on the balance sheet from the previous accounting period.

How do you calculate cost of goods sold for a service?

Calculating Cost of Goods Sold

Add the ending inventory value, the direct labor and the indirect costs to get your cost of goods sold for the accounting period. For example, if your beginning inventory is $5,000, add your inventory purchases of $6,000 and subtract your $4,000 ending inventory to get $7,000.

Is fuel included in COGS?

Cost of Goods Sold is an account in the Chart of Accounts that is a specific type of expenditure. … Construction businesses may have many COGS accounts, ranging from Direct Labor, Materials, Subcontractor, and Indirect COGS (things like fuel, job supplies, equipment maintenance, etc).

How do you calculate cost of goods sold?

The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the ending inventory for the period. The beginning inventory for the current period is calculated as per the leftover inventory from the previous year.

Is COGS a debit or credit?

Cost of Goods Sold is an EXPENSE item with a normal debit balance (debit to increase and credit to decrease). Even though we do not see the word Expense this in fact is an expense item found on the Income Statement as a reduction to Revenue.

How do you calculate cost of goods sold for a service?

Calculating Cost of Goods Sold

Add the ending inventory value, the direct labor and the indirect costs to get your cost of goods sold for the accounting period. For example, if your beginning inventory is $5,000, add your inventory purchases of $6,000 and subtract your $4,000 ending inventory to get $7,000.

What are cost of goods sold examples?

Examples of what can be listed as COGS include the cost of materials, labor, the wholesale price of goods that are resold, such as in grocery stores, overhead, and storage. Any business supplies not used directly for manufacturing a product are not included in COGS.

Is cost of goods sold Debit or credit?

Cost of Goods Sold is an EXPENSE item with a normal debit balance (debit to increase and credit to decrease). Even though we do not see the word Expense this in fact is an expense item found on the Income Statement as a reduction to Revenue.

What is the formula to calculate sales?

The sales revenue formula calculates revenue by multiplying the number of units sold by the average unit price. Service-based businesses calculate the formula slightly differently: by multiplying the number of customers by the average service price. Revenue = Number of Units Sold x Average Price.

How do you calculate cost of goods sold per unit?

You have $19,500 in cost of goods sold, an amount that goes right to the income statement. To figure out the cost per unit, divide the total cost by the 4,200 units sold: $3.64 ($19,500 ÷ 4,200 gallons). As you may know from your financial accounting course, retailers use this same formula.

What is balance sheet example?

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. It can also be referred to as a statement of net worth or a statement of financial position. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity.

Can you have cost of goods sold for services?

Many service companies do not have any cost of goods sold at all. … Not only do service companies have no goods to sell, but purely service companies also do not have inventories. If COGS is not listed on the income statement, no deduction can be applied for those costs.

What is the difference between COGS and operating expenses?

COGS includes direct labor, direct materials or raw materials, and overhead costs for the production facility. … Operating expenses are the remaining costs that are not included in COGS. Operating expenses can include: Rent.

Can you have COGS without sales?

Cost of Revenue vs. COGS. There are also costs of revenue for ongoing contract services that can even include raw materials, direct labor, shipping costs, and commissions paid to sales employees. Even these cannot be claimed as COGS without a physically produced product to sell, however.

Is Cost of Goods Sold Debit or credit?

Cost of Goods Sold is an EXPENSE item with a normal debit balance (debit to increase and credit to decrease). Even though we do not see the word Expense this in fact is an expense item found on the Income Statement as a reduction to Revenue.

Why would you debit COGS?

As the cost of goods sold is a debit account, debiting it will increase the cost of goods sold and reduce the company’s profits. The inventory account is of debit nature and crediting it will decrease the value of closing inventory. The cost of goods sold is also increased by incurring costs on direct labor.

Why do we debit COGS?

A debit to Cost of Goods Sold means that that account balance has increased. It also means that more goods have just been sold, and thus must be increased since the cost (expense) can now be taken against income. The other side of the journal entry would be a credit to Inventory for the same amount.

How do you adjust cost of goods sold?

Understated inventory increases the cost of goods sold. Recording lower inventory in the accounting records reduces the closing stock, effectively increasing the COGS. When an adjustment entry is made to add the omitted stock, this increases the amount of closing stock and reduces the COGS.