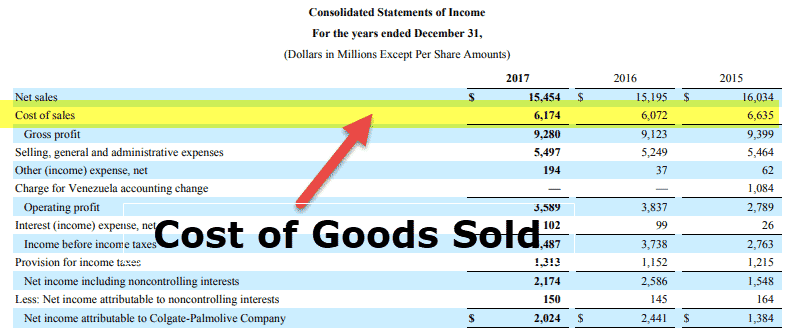

COGS/COS includes both direct labor costs, and any direct costs of materials used in producing or manufacturing a company’s products. … Cost of goods sold is subtracted from revenue to arrive at gross profit. In short, gross profit measures how well a company generates profit from their labor and direct materials.

Keeping this in consideration, Is it better to have a higher or lower COGS?

Cost of goods sold (COGS) includes all of the costs and expenses directly related to the production of goods. … COGS is deducted from revenues (sales) in order to calculate gross profit and gross margin. Higher COGS results in lower margins.

Secondly What 5 items are included in cost of goods sold? COGS expenses include:

- The cost of products or raw materials, including freight or shipping charges;

- The direct labor costs of workers who produce the products;

- The cost of storing products the business sells;

- Factory overhead expenses.

What expenses are not included in COGS?

Cost of goods sold is typically listed as a separate line item on the income statement. Operating expenses are the remaining costs that are not included in COGS.

…

Operating Expenses

- Rent.

- Utilities.

- Salaries/wages.

- Property taxes.

- Business travel.

Table of Contents

What happens if COGS decrease?

Start with net revenue, after deducting returns and discounts. Subtract COGS, leaving a figure called the gross profit or gross margin. Next, deduct other business expenses, such as marketing costs, administrative salaries, research and development and distribution costs to arrive at the net operating income.

What is the difference between COGS and expenses?

The difference between these two lines is that the cost of goods sold includes only the costs associated with the manufacturing of your sold products for the year while your expenses line includes all your other costs of running the business.

How do I calculate cost of goods sold?

The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the ending inventory for the period. The beginning inventory for the current period is calculated as per the leftover inventory from the previous year.

What is cost of goods sold on tax return?

Cost of goods sold (COGS) is an important line item on an income statement. It reflects the cost of producing a good or service for sale to a customer. The IRS allows for COGS to be included in tax returns and can reduce your business’s taxable income.

How do you find ending inventory without cost of goods sold?

To calculate the ending inventory, the new purchases are added to the ending inventory, minus the cost of goods sold. This provides the final value of the inventory at the end of the accounting period.

What is cost of goods sold vs expenses?

Cost of goods sold refers to the business expenses directly tied to the production and sale of a company’s goods and services. Simply put: COGS represents expenses directly incurred when a transaction takes place.

Is COGS the same as operating expense?

COGS includes direct labor, direct materials or raw materials, and overhead costs for the production facility. … Operating expenses are the remaining costs that are not included in COGS. Operating expenses can include: Rent.

What causes a decrease in COGS?

Cash discount: If a company starts bulk buying their materials, it will affect the Cost of Goods Sold. When buying in larger quantities from the same supplier, the supplier will offer quantity based discounts and decrease the COGS.

How do you reduce COGS?

Five Effective Ways to Reduce Cost of Goods Sold

- Buy in Bulk and Receive Discounts. When you buy in larger quantities you will often be able to take advantage of quantity discounts. …

- Substitute Lower Cost Materials Where Possible. …

- Leverage Suppliers. …

- Automation. …

- Move Manufacturing Offshore.

What factors affect COGS?

Factors Affecting the Cost of Goods Sold

Different factors contribute to the change in the cost of goods sold. This includes the prices of raw materials, maintenance costs, transportation costs, and the regularity of sales or business operations.

Is COGS a debit or credit?

Cost of Goods Sold is an EXPENSE item with a normal debit balance (debit to increase and credit to decrease). Even though we do not see the word Expense this in fact is an expense item found on the Income Statement as a reduction to Revenue.

Why are expenses separated from COGS?

While both OE and COGS are considered expense accounts from a bookkeeping point of view, they’re separated on the income statement to differentiate between money that’s spent to keep your company running, and money that’s spent to directly support the costs associated with providing your company’s product or service.

Is cost of goods sold Debit or credit?

Cost of Goods Sold is an EXPENSE item with a normal debit balance (debit to increase and credit to decrease). Even though we do not see the word Expense this in fact is an expense item found on the Income Statement as a reduction to Revenue.

What is cost of goods sold on income statement?

Cost of goods sold (COGS) on an income statement represents the expenses a company has paid to manufacture, source, and ship a product or service to the end customer.

How do you calculate cost of goods sold on a balance sheet?

The cost of goods sold formula, also referred to as the COGS formula is: Beginning Inventory + New Purchases – Ending Inventory = Cost of Goods Sold. The beginning inventory is the inventory balance on the balance sheet from the previous accounting period.

How do I calculate cost of goods sold with the IRS?

The Formula for Cost of Goods Sold

- Beginning Inventory Costs (at the beginning of the year)

- Plus Additional Inventory Cost (inventory purchased during the year and other costs)

- Minus Ending Inventory (at the end of the year)

- Equals Cost of Goods Sold.

Do I send a 1099 for cost of goods sold?

Do I have to send a Form 1099-MISC when I purchase goods or merchandise from an individual or company? No. Forms 1099-MISC are not required to report payments for goods or any freight or storage costs associated with that purchase.

Where is COGS on tax return?

For partnerships and multiple-member LLCs, the cost of goods sold is part of the partnership tax return (Form 1065). For corporations and S corporations, the cost of goods sold is included in the corporate tax return (Form 1120) or the S corporation tax return (Form 1120-S).

What is cost of goods sold with example?

Cost of goods sold is the accounting term used to describe the expenses incurred to produce the goods or services sold by a company. … Examples of what can be listed as COGS include the cost of materials, labor, the wholesale price of goods that are resold, such as in grocery stores, overhead, and storage.

How do you find ending inventory and cost of goods sold?

The basic formula for calculating ending inventory is: Beginning inventory + net purchases – COGS = ending inventory. Your beginning inventory is the last period’s ending inventory.

What is ending inventory on a balance sheet?

Ending inventory is the total unit quantity of inventory in stock or its total valuation at the end of an accounting period. The ending inventory figure is needed to derive the cost of goods sold, as well as the ending inventory balance to include in a company’s balance sheet.