Disadvantages

- Liabilities. In addition to sharing profits and assets, a partnership also entails sharing any business losses, as well as responsibility for any debts, even if they are incurred by the other partner. …

- Loss of Autonomy. …

- Emotional Issues. …

- Future Selling Complications. …

- Lack of Stability.

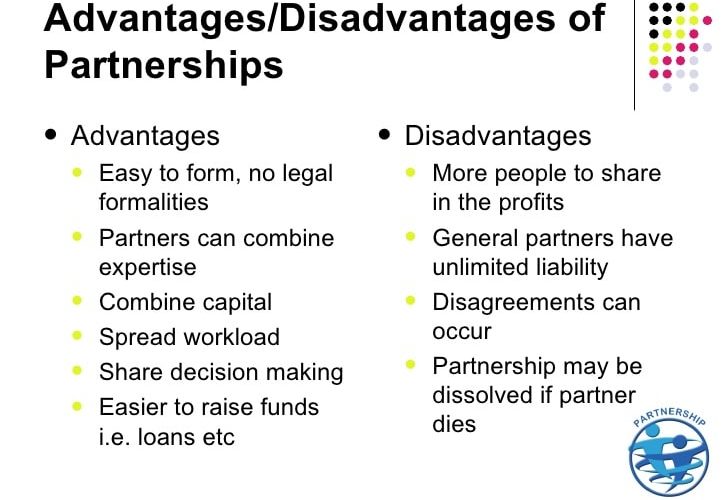

Keeping this in consideration, What is the advantage and disadvantage of partnership?

the liability of the partners for the debts of the business is unlimited. each partner is ‘jointly and severally’ liable for the partnership’s debts; that is, each partner is liable for their share of the partnership debts as well as being liable for all the debts.

Secondly Are partnerships a good idea? In theory, a partnership is a great way to start in business. In my experience, however, it’s not always the best way for the typical entrepreneur to organize a business. … Throw in some employees you must manage, and you have a good idea of the work required to make a business partnership successful.

Can a partner take a salary?

Under the IRS’ view, an individual cannot be both a partner and an employee for purposes of wage withholding, payroll taxes or FUTA (Revenue Ruling 69-184). … A partner’s salary is reported to the partner on a Schedule K-1 as a guaranteed payment rather than on a Form W-2.

Table of Contents

What are the tax advantages of a partnership?

Not only does income pass-through to each partner, but also the deductions and credits. This means that the profits are only taxed at a personal level. This helps a partnership avoid the double taxation that corporations face by paying corporate tax and then having to pay tax on their dividend shares.

What are the limitations of partnership?

The Major Limitations of Partnership Firm are as follows:

- (i) Uncertainty of duration: …

- (ii) Risks of additional liability: …

- (iii) Lack of harmony: …

- (iv) Difficulty in withdrawing investment: …

- (v) Lack of public confidence: …

- (vi) Limited resources: …

- (vii) Unlimited liability:

How do you dissolve a 50/50 partnership?

These, according to FindLaw, are the five steps to take when dissolving your partnership:

- Review Your Partnership Agreement. …

- Discuss the Decision to Dissolve With Your Partner(s). …

- File a Dissolution Form. …

- Notify Others. …

- Settle and close out all accounts.

What are the 4 types of partnership?

These are the four types of partnerships.

- General partnership. A general partnership is the most basic form of partnership. …

- Limited partnership. Limited partnerships (LPs) are formal business entities authorized by the state. …

- Limited liability partnership. …

- Limited liability limited partnership.

Why do partnerships fail?

Unequal Commitment Among Partners

In a partnership, you are dependent on the contributions of other partners, and if they are unable or unwilling to make the same level of personal or financial sacrifices, it will likely result in resentment and conflict.

Can partnership have employees?

In 1969, the IRS publicly ruled on the matter, stating that partners of a partnership are not employees of the partnership for purposes of FICA, FUTA, and federal income tax withholding and that a partner devoting time and energy conducting the partnership’s trade of business is considered self-employed and is not an …

How do you pay yourself in a partnership?

If you’re a partner, you can pay yourself by taking a portion of the profits your business earns as a draw. This amount is reported as part of the Schedule K-1. You’ll need to pay taxes on your share of the profits and losses of the partnership on your personal income tax returns.

Where do I report my partner salary on 1065?

For most partners in partnerships, totals in Schedule K-1 get included on Schedule E of the partner’s income tax return (usually Form 1040). Part II of Schedule E is “Income or Loss From Partnerships and S Corporations.” In this section, the partner must report partnership income and loss for the year.

How is tax calculated for a partnership?

Partners in firms are taxed on their share of the profits of the firm for the tax year, and the basis of tax is similar to that for the self employed. Each partner is effectively taxed as if he were a self employed business, with profits equal to his share of the profits of the firm.

What is the tax rate for partnership?

If you operate as a partnership, these retained profits will likely be taxed at your marginal individual tax rate, which is probably more than 25%. But if you incorporate, that $30,000 will be taxed at a lower 15% corporate rate.

How is taxable income calculated for a partnership?

Business income from a partnership is generally computed in the same manner as income for an individual. That is, taxable income is determined by subtracting allowable deductions from gross income. This net income is passed through as ordinary income to the partner on Schedule K-1.

What are the main features of a partnership?

A typical partnership form of business will always have the following basic features.

- Agreement. The definition of the partnership itself makes it clear that there must exist an agreement between partners to work together and share profits amongst them. …

- Business. …

- Profit sharing. …

- Principal-agency relationship.

What are the advantages of sole proprietorship over partnership?

These are the main benefits of a sole proprietorship over a partnership: It’s easier and cheaper to form. It has fewer government regulations. As the sole owner, you have complete control over your business.

Why is a partnership better than a sole trader?

There are benefits associated with running a partnership, both when compared to a sole trader and a limited company: Shared responsibility. Having more business owners allows the financial and operational responsibility for running the business to be shared. … Conventional partnerships are easier to form than LLPs.

Can I force my business partner to buy me out?

Your partners generally cannot refuse to buy you out if you had the foresight to include a buy-sell or buyout clause in your partnership agreement. … You can include language that a buyout is mandatory if one partner requests it. This would insure that if you want your partners to buy you out, they must.

Does partnership income have to be split 50 50?

However, generally speaking, partnerships don’t have to be equally divided between partners. Partners should agree how income or losses will be distributed to partners, and many partnerships find it beneficial to draw up a partnership agreement.

How do you dissolve a partnership without a contract?

Dissolving a Business Partnership Without an Agreement hide

- Review Written Agreements.

- Consult a Partnership Attorney.

- Discuss Dissolution with Your Partners.

- Negotiate a Separation Agreement.

- Address Unresolved Matters in Court.

- Wind Up the Partnership.

- Notify Everyone.

Which type of partnership is best?

Types of businesses that typically form LLC partnerships: Companies whose owners want liability protection from the business while still being involved in the day-to-day management and operations. Since LLC partnerships can be formed by most types of businesses, they’re generally a good fit for most people.

How do partnerships work?

A partnership consists of two or more persons or entities doing business together. There are three main types of partnership: general, limited, and limited liability. … Each partner invests in the business and shares in its profits and losses. Partners may or may not be liable for the actions taken by the company.

How would you describe a good partnership?

Cohesion. Trust is a basic need for a successful partnership. … Elite partnerships are made up of people who view each other as necessary equals and show mutual respect for each other’s differences. They find ways to focus on solutions, not problems and are committed to open communication to keep things together.

Add comment