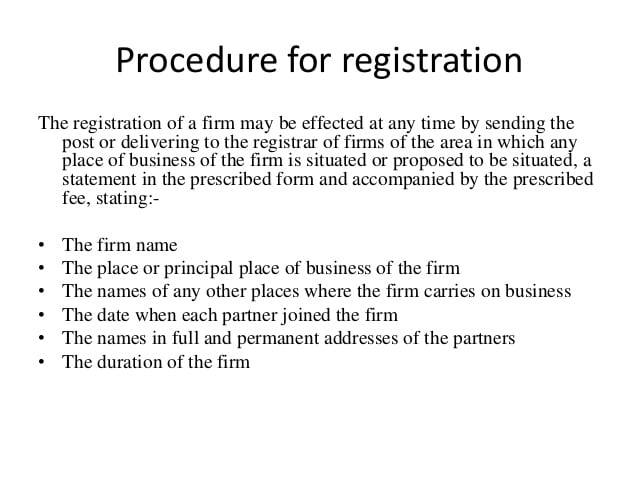

Procedure of Registration

- Application to the Registrar of Firms in the prescribed form (Form A). …

- The duly signed copy of the Partnership Deed (which contains all the terms and conditions) must be filled with the registrar.

- Deposit/pay the necessary fees and stamp duties.

Keeping this in consideration, What are the advantages and disadvantages of registration of partnership firm?

Advantages and Disadvantages of a Partnership Firm

- Easy to Start. Partnership firms are one of the easiest to start. …

- Decision Making. Decision making is the crux of any organization. …

- Raising of Funds. …

- Sense of Ownership. …

- Unlimited Liability. …

- Number of Members. …

- Lack of a Central Figure. …

- Trust of the General Public.

Secondly In which type of partnership registration is compulsory? The Registration of a partnership firm is not compulsory under Part vii of the Indian Partnership Act, 1932, though it is usually done as registration brings many advantages to the firm. It is optional for partners to set the firm registered and there are no penalties for non-registration.

What are the requirements and procedure in partnership registration?

Requirements:

- Registration with DTI or SEC (depending on partnership’s capital)

- Submission of duly notarized Articles of Partnership.

- Submission of SEC form F-105 (for partnerships with foreign members)

- Procurement of licenses and clearances from necessary government offices.

- Registration with BIR.

Table of Contents

What are the disadvantages of partnership?

Disadvantages

- Liabilities. In addition to sharing profits and assets, a partnership also entails sharing any business losses, as well as responsibility for any debts, even if they are incurred by the other partner. …

- Loss of Autonomy. …

- Emotional Issues. …

- Future Selling Complications. …

- Lack of Stability.

What are the limitations of partnership?

The Major Limitations of Partnership Firm are as follows:

- (i) Uncertainty of duration: …

- (ii) Risks of additional liability: …

- (iii) Lack of harmony: …

- (iv) Difficulty in withdrawing investment: …

- (v) Lack of public confidence: …

- (vi) Limited resources: …

- (vii) Unlimited liability:

What are the legal requirements for partnership?

PARTNERSHIP BUSINESS LAW

- two or more partners who shall all shoulder unlimited liabilities according to the law;

- a partnership agreement in written form;

- capital fund contributed by all partners;

- a name of the business concerned;

- operating sites and conditions of the business.

What documents are needed for a partnership?

Related Documents

- Partnership Agreement.

- Dissolution of Partnership Deed.

- Website Terms of Use.

- Sale of Goods Agreement.

- Employment Contract.

- Supply of Services Agreement.

- Memorandum of Understanding (MOU)

- Website Privacy Policy.

How does a partnership operate?

A partnership consists of two or more persons or entities doing business together. There are three main types of partnership: general, limited, and limited liability. … Each partner invests in the business and shares in its profits and losses. Partners may or may not be liable for the actions taken by the company.

What is the advantage and disadvantage of partnership?

the liability of the partners for the debts of the business is unlimited. each partner is ‘jointly and severally’ liable for the partnership’s debts; that is, each partner is liable for their share of the partnership debts as well as being liable for all the debts.

What are the tax benefits of a partnership?

Businesses as partnerships do not have to pay income tax; each partner files the profits or losses of the business on his or her own personal income tax return. This way the business does not get taxed separately. Easy to establish. There is an increased ability to raise funds when there is more than one owner.

What are two advantages and two disadvantages of a partnership?

Advantages and disadvantages of a partnership business

- 1 Less formal with fewer legal obligations. …

- 2 Easy to get started. …

- 3 Sharing the burden. …

- 4 Access to knowledge, skills, experience and contacts. …

- 5 Better decision-making. …

- 6 Privacy. …

- 7 Ownership and control are combined. …

- 8 More partners, more capital.

What are the main features of a partnership?

A typical partnership form of business will always have the following basic features.

- Agreement. The definition of the partnership itself makes it clear that there must exist an agreement between partners to work together and share profits amongst them. …

- Business. …

- Profit sharing. …

- Principal-agency relationship.

What are the benefits of a general partnership?

General partnerships benefit from pass-through taxation, where taxes on the business’ profits or losses pass through the business entity directly to the business owners’ personal taxes. Other business structures, like corporations, must pay taxes twice — first on a business level, and second on a personal level.

What are the pros and cons of a partnership?

Pros and cons of a partnership

- You have an extra set of hands. …

- You benefit from additional knowledge. …

- You have less financial burden. …

- There is less paperwork. …

- There are fewer tax forms. …

- You can’t make decisions on your own. …

- You’ll have disagreements. …

- You have to split profits.

What should the partnership do to make the contract of partnership valid?

ESSENTIAL FEATURES:

- There must be a valid contract.

- The parties must have legal capacity to enter into the contract.

- There must be a mutual contribution of money, property, or industry to a common fund.

- The object must be lawful.

- The purpose or primary purpose must be to obtain profits and divide the same among the parties.

What are the three requirements to form a partnership?

Forming a Partnership

- Choose a business name for the partnership and check for availability.

- Register the business name with local, state, and/or federal authorities. …

- Negotiate and execute a partnership agreement. …

- Obtain any required local licenses.

What are the 4 types of partnership?

These are the four types of partnerships.

- General partnership. A general partnership is the most basic form of partnership. …

- Limited partnership. Limited partnerships (LPs) are formal business entities authorized by the state. …

- Limited liability partnership. …

- Limited liability limited partnership.

Is a partnership easy to start?

A partnership is an agreement between two or more people to finance and operate a business. Partnerships, unlike sole proprietorships, are entities legally separate from the partners themselves. … Partnerships are relatively easy to establish; however, time should be invested in developing the partnership agreement.

What are three advantages of partnership?

A partnership may offer many benefits for your particular business.

- Bridging the Gap in Expertise and Knowledge. …

- More Cash. …

- Cost Savings. …

- More Business Opportunities. …

- Better Work/Life Balance. …

- Moral Support. …

- New Perspective. …

- Potential Tax Benefits.

What are the advantages and disadvantages of a partnership?

Partnership – advantages and disadvantages

- two heads (or more) are better than one.

- your business is easy to establish and start-up costs are low.

- more capital is available for the business.

- you’ll have greater borrowing capacity.

- high-calibre employees can be made partners.

What is the importance of partnership?

Partnerships increase your lease of knowledge, expertise, and resources available to make better products and reach a greater audience. All of these put together along with 360-degree feedback can skyrocket your business to great heights. The right business partnership will enhance the ethos of your firm.

How is tax calculated for a partnership?

Partners in firms are taxed on their share of the profits of the firm for the tax year, and the basis of tax is similar to that for the self employed. Each partner is effectively taxed as if he were a self employed business, with profits equal to his share of the profits of the firm.

What are two features of a partnership?

The main features of partnership firm are as follows:

- Two or More Persons: There must be at least two persons to form a partnership. …

- Agreement: …

- Lawful Business: …

- Sharing of Profits: …

- Mutual Agency (i.e., Principal Agent Relationship): …

- No Separate Legal Existence: …

- Unlimited Liability:

What are 5 characteristics of a partnership?

Partnership Firm: Nine Characteristics of Partnership Firm!

- Existence of an agreement: …

- Existence of business: …

- Sharing of profits: …

- Agency relationship: …

- Membership: …

- Nature of liability: …

- Fusion of ownership and control: …

- Non-transferability of interest:

What are the five essential features of partnership?

Essential features of partnerships.

- There must be a valid contract;

- The parties must have legal capacity to enter into the contract;

- There must be a mutual contribution of money, property, or. industry to a common fund;

- The object must be lawful; and.

- The purpose or primary purpose must be to obtain profits and.