10 Warning Signs of Identity Theft

- An unfamiliar loan or credit account on your credit report. …

- An inexplicable denial of credit. …

- Bills for accounts you know nothing about. …

- An unexpected drop in your credit score. …

- Collections agency calls for overdue accounts you know nothing about.

Keeping this in consideration, How common is ID theft?

Identity theft affects about 1 in 20 American each year. According to Javelin’s 2020 Identity Fraud Survey, 13 million consumers in the U.S. were affected by identity fraud in 2019 with total fraud losses of nearly $17 billion.

Secondly What are 3 things you should do if you learn your identity has been stolen or compromised?

- File a claim with your identity theft insurance, if applicable. …

- Notify companies of your stolen identity. …

- File a report with the FTC. …

- Contact your local police department. …

- Place a fraud alert on your credit reports. …

- Freeze your credit. …

- Sign up for a credit monitoring service, if offered.

What do identity thieves look for?

Any of these pieces of information are fair game for identity thieves, though some are more valuable than others: SSN, date of birth, credit card numbers, driver’s license number, Social Security card, passwords and usernames, rewards account numbers, and more.

Table of Contents

What is the most common form of identity theft?

Financial identity theft is by far the most common type of identity theft. In 2014, identity thieves stole $16 billion from 12.7 million identity fraud victims, according to Javelin Strategy & Research.

What harms are caused by identity theft?

Damaged credit: If an identity thief steals your Social Security number (SSN), opens new accounts in your name and never pays, it could ruin your credit history. Not only can this impact your ability to get credit, but it can also hurt your job prospects and increase your auto and homeowners insurance premiums.

How do you check if your identity has been stolen?

How to check if your identity has been stolen

- Check your credit card statements and bank account. If you notice any suspicious activity, alert your bank or credit union right away. …

- Run a credit report. U.S. citizens are entitled to a free one every 12 months. …

- Monitor your finances closely.

How long does it take to investigate identity theft?

On average, it can take 100 to 200 hours over six months to undo identity theft. The recovery process may involve working with the three major credit bureaus to request a fraud alert; reviewing your credit reports to pinpoint fraudulent activity; and reporting the theft.

How can you protect yourself from identity theft?

- 10 Ways To Protect Yourself From Identity Theft. …

- Destroy private records and statements. …

- Secure your mail. …

- Safeguard your Social Security number. …

- Don’t leave a paper trail. …

- Never let your credit card out of your sight. …

- Know who you’re dealing with. …

- Take your name off marketers’ hit lists.

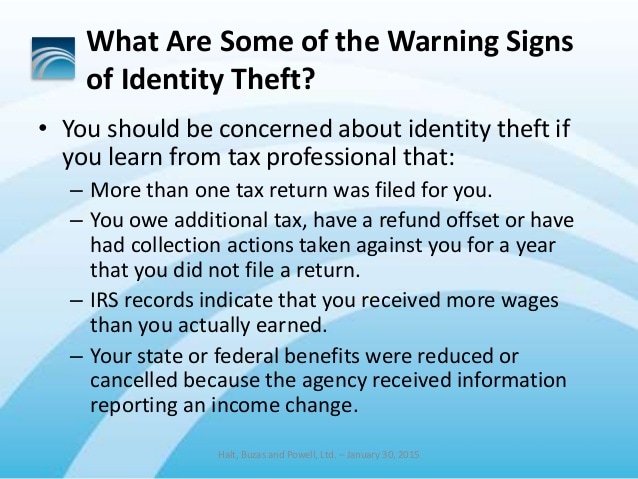

What are 2 warning signs that your identity may have been stolen?

9 warning signs of identity theft

- Your bank statement doesn’t look right or your checks bounce. …

- You see unfamiliar and unauthorized activity on your credit card or credit report. …

- Your bills are missing or you receive unfamiliar bills. …

- Your cellphone or another utility loses service.

Can someone steal your identity with just your name?

This is commonly referred to as personally identifiable information, or PII. When such information is linked to your name, it gives the thief easy access to your identity. Armed with just your name and your Social Security number, a thief can not only access your accounts but also obtain credit in your name.

What do hackers do with your stolen identity?

Your info could be used to open credit cards or take out loans. If hackers have your Social Security number, name, birthdate and address, they can open credit cards or apply for loans in your name.

What is needed to steal my identity?

Identity theft begins when someone takes your personally identifiable information such as your name, Social Security Number, date of birth, your mother’s maiden name, and your address to use it, without your knowledge or permission, for their personal financial gain.

What are the 4 types of identity theft?

The four types of identity theft include medical, criminal, financial and child identity theft.

Can you ever recover from identity theft?

On average, it can take between 100 and 200 hours and six months to fix. But in some cases, it can take thousands of hours and years to resolve fully. Several key factors determine the length of the recovery process, but before we review those, let’s look at the steps involved in resolving identity theft.

What are the long term negative effects of identity theft?

In its 2016 ITRC survey, 23 percent of ID theft victims surveyed feared for their physical safety, 39 percent experienced an inability to focus, 29 percent reported new physical illnesses such as body pain, sweating, and heart and stomach issues, 41 percent had sleep issues, and 10 percent couldn’t go to work due to …

How can we avoid identity theft?

11 ways to prevent identity theft

- Freeze your credit. …

- Safeguard your Social Security number. …

- Be alert to phishing and spoofing. …

- Use strong passwords and add an authentication step. …

- Use alerts. …

- Watch your mailbox. …

- Shred, shred, shred. …

- Use a digital wallet.

Can someone use my SSN with their name?

A dishonest person who has your Social Security number can use it to get other personal information about you. Identity thieves can use your number and your good credit to apply for more credit in your name. … The Social Security Administration protects your Social Security number and keeps your records confidential.

What are the four types of identity theft?

The four types of identity theft include medical, criminal, financial and child identity theft.

What are 2 ways that you can reduce the risk of identity theft?

In this article:

- Monitor Your Credit.

- Keep Your Personal Documents Safe.

- Secure Your Online Data.

- Create Strong Passwords.

- Enlist Help to Protect Your Information.

Can you fully recover from identity theft?

On average, it can take between 100 and 200 hours and six months to fix. But in some cases, it can take thousands of hours and years to resolve fully. Several key factors determine the length of the recovery process, but before we review those, let’s look at the steps involved in resolving identity theft.

Does identity theft ruin your life?

Damaged credit: If an identity thief steals your Social Security number (SSN), opens new accounts in your name and never pays, it could ruin your credit history. Not only can this impact your ability to get credit, but it can also hurt your job prospects and increase your auto and homeowners insurance premiums.

How much does it cost to recover from identity theft?

The average loss for a victim of identity theft is $1,100, according to the Javelin study.

How does a stolen identity affect your life?

Damaged credit: If an identity thief steals your Social Security number (SSN), opens new accounts in your name and never pays, it could ruin your credit history. Not only can this impact your ability to get credit, but it can also hurt your job prospects and increase your auto and homeowners insurance premiums.