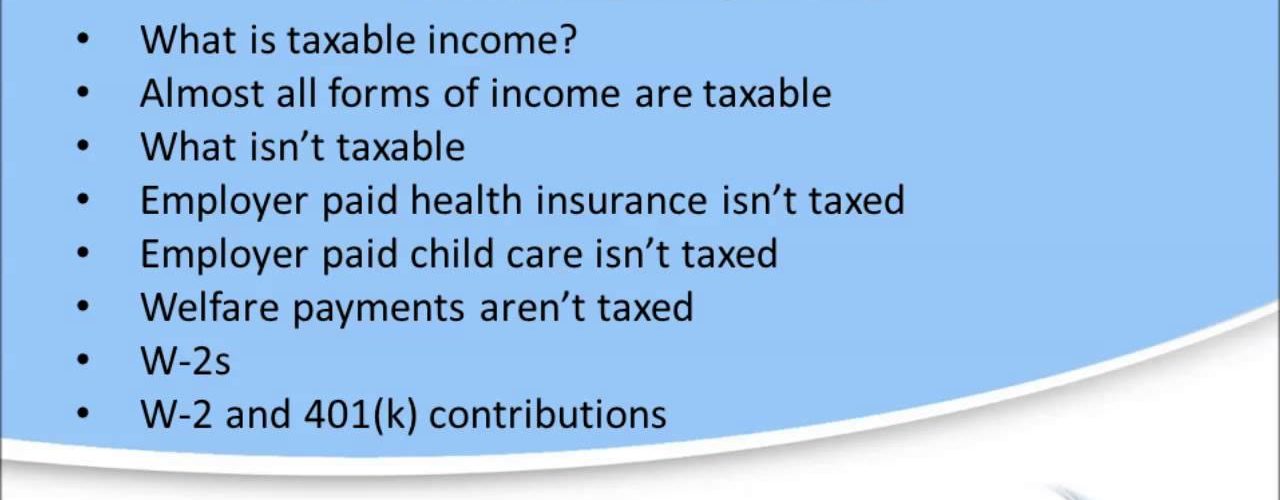

Nontaxable income won’t be taxed, whether or not you enter it on your tax return. The following items are deemed nontaxable by the IRS: Inheritances, gifts and bequests. Cash rebates on items you purchase from a retailer, manufacturer or dealer.

Keeping this in consideration, How do we pay taxes to the government?

Paying Your Taxes

- Bank Account (Direct Pay)

- Pay by Debit or Credit Card.

- Payment Plan.

- Deposit Taxes.

- Tax Withholding.

- Understand Your IRS Notice.

- Foreign Electronic Payments.

- Payment of User Fees (IVES, Historic Easement, U.S. Residency)

Secondly What passive income is not taxed? Passive income, from rental real estate, is not subject to high effective tax rates. Income from rental real estate is sheltered by depreciation and amortization and results in a much lower effective tax rate. For example, let’s say you own a rental property that nets $10,000 before depreciation and amortization.

How much money can you make without paying taxes?

The amount that you have to make to not pay federal income tax depends on your age, filing status, your dependency on other taxpayers and your gross income. For example, in the year 2018, the maximum earning before paying taxes for a single person under the age of 65 was $12,000.

Table of Contents

Do you legally have to pay income tax?

The Law: The requirement to pay taxes is not voluntary. Section 1 of the Internal Revenue Code clearly imposes a tax on the taxable income of individuals, estates, and trusts, as determined by the tables set forth in that section.

What are 3 types of taxes?

Tax systems in the U.S. fall into three main categories: Regressive, proportional, and progressive.

How can I make $1000 a month passive income?

9 Passive Income Ideas that earn $1000+ a month

- Start a YouTube Channel. …

- Start a Membership Website. …

- Write a Book. …

- Create a Lead Gen Website for Service Businesses. …

- Join the Amazon Affiliate Program. …

- Market a Niche Affiliate Opportunity. …

- Create an Online Course. …

- Invest in Real Estate.

How can I make passive income in 2020?

Here are a few passive income ideas to help you build up your personal wealth.

- Make Money from Daily Activities. …

- Make Your Car Work for You. …

- Get a High-Yield Savings Account. …

- Rent out a Room in Your House. …

- Invest in Crowdfunded Real Estate. …

- Invest in Dividend Paying Stocks. …

- Peer-To-Peer Lending. …

- Affiliate Marketing.

How can I make passive income?

23 Passive Income Ideas 2021

- Start a Dropshipping Store. Get Started with Oberlo. …

- Run a Blog. The most popular passive income stream tends to come from blogging. …

- Create a Course. …

- Instagram Sponsored Posts. …

- Create a Print on Demand Online Store. …

- Create an App. …

- Invest in Stocks. …

- Buy Property.

At what age do seniors stop paying taxes?

Updated for Tax Year 2019

You can stop filing income taxes at age 65 if: You are a senior that is not married and make less than $13,850.

Does Social Security count as income?

Social Security benefits do not count as gross income. However, the IRS does count them in your combined income for the purpose of determining if you must pay taxes on your benefits.

Can I file taxes if I made less than 3000?

As you can see, if you are a single dependent, you have to earn more than $6,350 in 2017 from all earned income sources combined before you must file taxes on those earnings. And if you made $3,000 you do not have to file taxes as this amount is clearly less than this minimum threshold.

How can I legally not pay taxes?

How to Reduce Taxable Income

- Contribute significant amounts to retirement savings plans.

- Participate in employer sponsored savings accounts for child care and healthcare.

- Pay attention to tax credits like the child tax credit and the retirement savings contributions credit.

- Tax-loss harvest investments.

What law says you have to pay income tax?

The Internal Revenue Code is the law that requires people to pay taxes and if you believe the folks who say it’s only a legal requirement as assessed, they’re wrong. There are even laws against acting on the various claims that are advocated by tax protesters.

What is a good tax system?

A good tax system should meet five basic conditions: fairness, adequacy, simplicity, transparency, and administrative ease. Although opinions about what makes a good tax system will vary, there is general consensus that these five basic conditions should be maximized to the greatest extent possible.

Which type of tax is best?

In the United States, the historical favorite is the progressive tax. Progressive tax systems have tiered tax rates that charge higher income individuals higher percentages of their income and offer the lowest rates to those with the lowest incomes. Flat tax plans generally assign one tax rate to all taxpayers.

What are the 7 types of taxes?

Here are seven ways Americans pay taxes.

- Income taxes. Income taxes can be charged at the federal, state and local levels. …

- Sales taxes. Sales taxes are taxes on goods and services purchased. …

- Excise taxes. …

- Payroll taxes. …

- Property taxes. …

- Estate taxes. …

- Gift taxes.

How much money do I need to invest to make $3000 a month?

By this calculation, to get $3,000 a month, you would need to invest around $108,000 in a revenue-generating online business. Here’s how the math works: A business generating $3,000 a month is generating $36,000 a year ($3,000 x 12 months).

How can I make $500 a month on the side?

15 Ways To Make An Extra $500 A Month From Home

- Get paid to take online surveys while watching Netflix.

- Make money delivering food with DoorDash. …

- Teach English as a foreign language. …

- Bake homemade dog treats. …

- Get paid to lose weight with HealthyWage. …

- Make $500 a month reselling stuff from thrift stores.

What are the 7 streams of income?

7 Different Types of Income Streams

- Active & Passive Income Streams.

- Diversification.

- Earned Income.

- Profit Income.

- Interest Income.

- Dividend Income.

- Rental Income.

- Capital Gains Income.

How can I make 50 dollars a day passive?

Here are just 5 of the best ways to make $50 a day working online:

- Start selling on eBay. Becoming an eBay seller is easy, inexpensive, and if you have a knack for sales, it can become very profitable. …

- Start selling on Poshmark. …

- Work as a freelance writer. …

- Find a social media marketing job. …

- Take surveys.

What can I do for extra money?

It’s time to put your money goals into action and earn some extra cash.

…

How to Make Extra Money by Selling or Renting

- Rent your home. …

- Rent out your car. …

- Sell old phones and electronics. …

- Get rid of old movies and music. …

- Rent out your baby gear. …

- Sell unwanted stuff. …

- Sell your kid’s clothes. …

- Sell those unused gift cards.

How can I make money while I sleep?

20 Ways to Earn Money While You’re Sleeping

- Invest in Real Estate. …

- Invest in Crowdfunded Real Estate. …

- Buy Stocks That Pay Dividends. …

- Write and Publish a Book. …

- Affiliate Marketing on Your Website or Blog. …

- Start a Drop Shipping Website. …

- Get an Autoresponder for Your Online Business. …

- Create an Online Course.

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free. However, if you’re still working, part of your benefits might be subject to taxation.

Does a 75 year old have to file taxes?

The IRS requires you to file a tax return when your gross income exceeds the sum of the standard deduction for your filing status plus one exemption amount. If you are a senior, however, you don’t count your Social Security income as gross income. …

Can I get a tax refund if my only income is Social Security?

As a very general rule of thumb, if your only income is from Social Security benefits, they won’t be taxable, and you don’t need to file a return. But if you have income from other sources as well, there may be taxes on the total amount.

Add comment