A sample budget is a budget from another family that you can look over to help you create your own budget. This isn’t something that is discussed often, even amongst friends, so it’s really hard to see specifics of how others spend their money.

Keeping this in consideration, How do you create a budget plan?

How to Make a Budget in Six Simple Steps

- Gather Your Financial Paperwork.

- Calculate Your Income.

- Create a List of Monthly Expenses.

- Determine Fixed and Variable Expenses.

- Total Your Monthly Income and Expenses.

- Make Adjustments to Expenses.

Secondly What is a simple budget plan? What is a simple spending plan? A simple spending plan is an easy way to budget that helps you save money, get out of debt, pay your bills on time, and still allows you the freedom to spend money on things you value – within reason of course.

What is the 50 20 30 budget rule?

Senator Elizabeth Warren popularized the so-called “50/20/30 budget rule” (sometimes labeled “50-30-20”) in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

Table of Contents

What is the 70 20 10 Rule money?

Both 70-20-10 and 50-30-20 are elementary percentage breakdowns for spending, saving, and sharing money. Using the 70-20-10 rule, every month a person would spend only 70% of the money they earn, save 20%, and then they would donate 10%.

What are the 3 main budget categories?

Divvy your income into three categories: needs, wants, and savings and debt repayment.

What should I include in my budget?

Here are 20 common things to include in a budget:

- Rent.

- Groceries.

- Daily Incidentals.

- Irregular Expenses and Emergency Fund.

- Household Maintenance.

- Work Wardrobe and Upkeep.

- Subscriptions.

- Guests.

What is the 60 30 10 rule budget?

The 60/30/10 rule budget advocates saving 60% of your income, then dividing the rest between needs and wants. Saving and investing 60% of your budget could help you reach your dreams of retiring early and achieve financial independence.

What is a good budget for rent?

How much should you spend on rent? Try the 30% rule. One popular rule of thumb is the 30% rule, which says to spend around 30% of your gross income on rent. So if you earn $2,800 per month before taxes, you should spend about $840 per month on rent.

What is the 70/30 rule?

The 70% / 30% rule in finance helps many to spend, save and invest in the long run. The rule is simple – take your monthly take-home income and divide it by 70% for expenses, 20% savings, debt, and 10% charity or investment, retirement.

What is the 10 savings rule?

The 10% savings rule is a simple equation: your gross earnings divided by 10. Money saved can help build a retirement account, establish an emergency fund, or go toward a down payment on a mortgage. … Adjust your savings accordingly if faced with a low income or severe debt, but don’t give up entirely.

What are the 3 rules of money?

The three Golden Rules of money management

- Golden Rule #1: Don’t spend more than you make.

- Golden Rule #2: Always plan for the future.

- Golden Rule #3: Help your money grow.

- Your banker is one of your best sources of money management advice.

What are the 4 types of expenses?

If the money’s going out, it’s an expense. But here at Fiscal Fitness, we like to think of your expenses in four distinct ways: fixed, recurring, non-recurring, and whammies (the worst kind of expense, by far).

What is the first step in preparing a budget?

The following steps can help you create a budget.

- Step 1: Note your net income. The first step in creating a budget is to identify the amount of money you have coming in. …

- Step 2: Track your spending. …

- Step 3: Set your goals. …

- Step 4: Make a plan. …

- Step 5: Adjust your habits if necessary. …

- Step 6: Keep checking in.

How is a budget most effective?

A very effective budgeting strategy is to set aside savings as soon as you get paid. By doing so, you avoid the temptation to spend that money later in the month. … If you plan to have extra money to put toward credit card debt, for example, don’t let that money sit in your checking account until your payment is due.

What are the 4 steps in preparing a budget?

4 Steps to Creating a Budget You’ll Actually Follow

- STEP 1: MONEY IN. List your sources of income for the month. …

- STEP 2: MONEY OUT. Next, look back over your last few months of bank statements to help you list all of your monthly expenses. …

- STEP 3: ASSESS THE SITUATION. …

- STEP 4: Using and Maintaining Your Budget.

What does a good budget look like?

Setting budget percentages

That rule suggests you should spend 50% of your after-tax pay on needs, 30% on wants, and 20% on savings and paying off debt. While this may work for some, it’s often better to start with a more detailed categorizing of expenses to get a better handle on your spending.

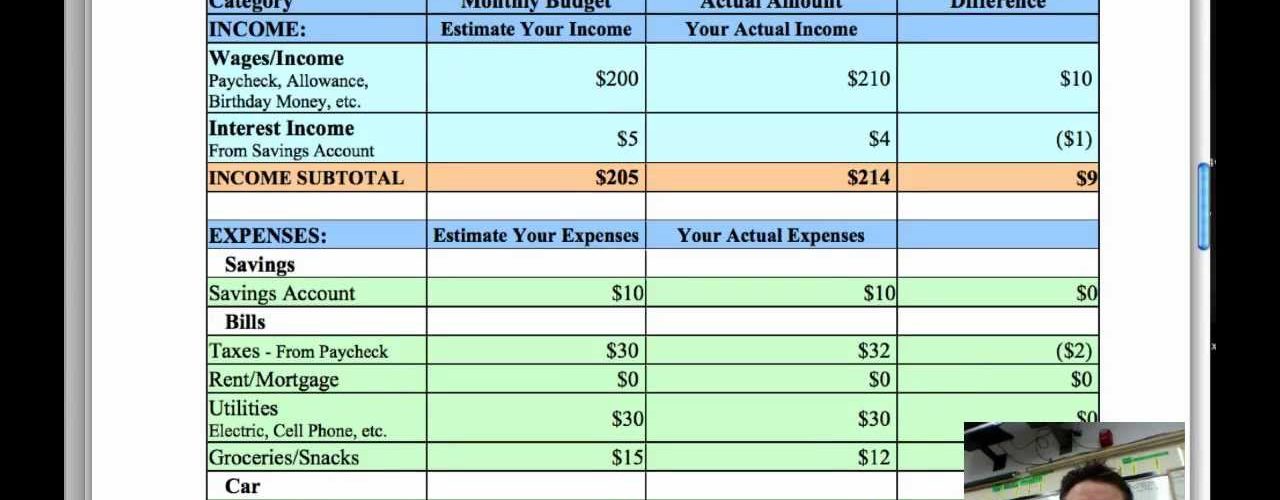

What is a line item in a budget?

A line-item budget is one in which the individual financial statement items are grouped by category. It shows the comparison between the financial data for the past accounting or budgeting periods and estimated figures for the current or a future period.

What is the 60 30 10 decorating rule?

What is the 60-30-10 Rule? It’s a classic decor rule that helps create a color palette for a space. It states that 60% of the room should be a dominant color, 30% should be the secondary color or texture and the last 10% should be an accent.

What is the 70/30 rule in finance?

The 70/30 Rule

Take your monthly take-home income and divide it by 70% and 30% and divvy up the percentages as so: 70% is for monthly expenses (anything spends money on) 10% goes into savings unless you have pressing debt in which case it goes toward debt first. 10% goes to investments, retirement, saving for college.

How do you budget for $1500 a month?

Here are 15 important tips and tricks for living on a budget of $1,500 or less each month:

- Make a Budget.

- Prioritize – Wise Up About How to Spend Money.

- Reduce Your Big Expenses.

- Examine and Cut Back Your Small Expenses.

- Have a Savings Account for Unexpected or Irregular Bills.

How much should you make to afford $1500 rent?

When deciding how much you should spend on rent, the rule of thumb is that your monthly rent should be no more than 30% of your gross monthly income or 40 times of your annual gross income. For example, if your annual income is $60,000, ideally should spend $1500 on monthly rent.

How much should you spend on rent and utilities?

The general rule is that your monthly apartment rent (excluding utilities) should not exceed 30% of your gross monthly income.

How much rent can I afford making 12 an hour?

Many landlords like to see income that is three times the amount of the rent. So, $12 per hr for 40 hrs would be $480/week. Assuming 4.33 weeks in a month, that would be $2,078.40 monthly.

Add comment