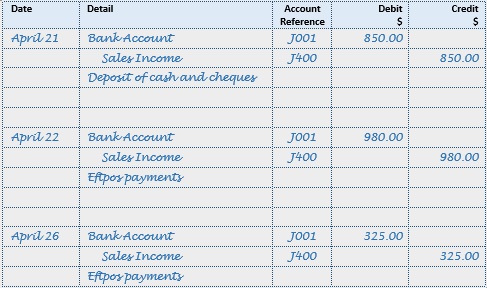

Debit: The cash is deposited at the bank increasing the balance in the bank account. Credit: Physical cash held by the business reduces when deposited at the bank. It should be noted that the cash deposit bank journal entry simply transfers cash from one location to another, the asset the business has is always cash.

Keeping this in consideration, What is the postage stamp?

a small gummed label issued by postal authorities that can be affixed to an envelope, postcard, or package as evidence that postal charges have been paid. FLOCK TO THIS QUIZ ON AMAZING ANIMAL ADJECTIVES NOW! Also called stamp.

Secondly When cash is deposited into bank account which account is debited? When the cash is deposited to the bank account, two things also change, on the bank side: the bank records an increase in its cash account (debit) and records an increase in its liability to the customer by recording a credit in the customer’s account (which is not cash).

What account title is deposit?

The depositor account title indicates the ownership of the funds in a deposit account. Put simply, it is the name that appears on the deposit account record. The bank then records the funds as both an asset and a liability towards the individual(s) or entity holding the depositor account title.

Table of Contents

Is postage stamps part of petty cash?

Petty cash funds are small amounts of cash that businesses use to pay for low-cost expenses, like postage stamps or donuts for a meeting.

When should you use a stamp?

Use a Forever stamp for most standard mail items.

Forever stamps are useful for mailing letters, greeting cards, and paper items weighing less than 1 ounce (28 g). To send a standard commercial envelope somewhere outside the United States, you’ll need to use a Global Forever stamp.

When a bank receives cash from a depositor?

When cash is received, debit Cash. When cash is paid out, credit Cash. To increase an asset, debit the asset account. To increase a liability, credit the liability account.

How do you account for deposits received?

In your accounting journal, debit the Cash account and credit the Customer Deposits account in the same amount. Send an invoice to the customer for the work after it has been completed. Note on the invoice the amount of the deposit previously paid and subtract it from the total amount owed.

What are the three golden rules of accounting?

To apply these rules one must first ascertain the type of account and then apply these rules.

- Debit what comes in, Credit what goes out.

- Debit the receiver, Credit the giver.

- Debit all expenses Credit all income.

Are taxes a liability or an expense?

Tax expense affects a company’s net earnings given that it is a liability that must be paid to a federal or state government. The expense reduces the amount of profits to be distributed to shareholders in the form of dividends.

How do I record owner’s withdrawals?

To record an owner withdrawal, the journal entry should debit the owner’s equity account and credit cash. Since only balance sheet accounts are involved (cash and owner’s equity), owner withdrawals do not affect net income.

What do I do with unused stamps?

What to do with unused stamps

- Sell them to a stamp buying service. Stamp buying services, like Sell Unused Stamps, will pay you cash for your unused postage. …

- Use them to mail letters or packages. …

- Return them to the Post Office. …

- Want To Sell Your Stamps For Cash?

What are the 5 petty cash controls?

A functioning petty cash system includes internal controls to ensure that all transactions are recorded and that purchase amounts reconcile with the sum remaining in the fund.

- Petty Cash Log. …

- Reconciliation. …

- Bookkeeping Interface. …

- Locking the Box.

Is petty cash an asset?

Petty cash is a current asset and should be listed as a debit on the company balance sheet.

What can I mail with a stamp?

You can attach stamps to large envelopes and small packages to be sent through First Class Mail as long as you’ve met USPS’s weight restrictions. It costs $1.00 to send the first ounce of a large envelope and $3.01 and up for the first 3 ounces of a small package.

Can I put 2 stamps on a large letter?

Can I just put two stamps on a large letter? As long as you don’t underpay you can combine stamps. Even old 1st class stamps as long as they don’t have a value printed on them can be used, they will be treated as paying this year’s 1st class price.

What happens when you post a letter without a stamp?

What happens when you send mail without a stamp. … If not, the intended recipient may have had to pay postage, according to USPS protocol. If the recipient refuses to pay the postage, your mail could become an unclaimed letter held by the post office for a time, before it is finally destroyed or used to fund the USPS.

Are customer deposits liabilities?

A customer deposit is money from a customer to a company before the company earns it. … It follows the accounting principle; the deposit is a current liability that is debited and sales revenue credited. A customer deposit could also be the amount of money deposited in a bank.

Are customer deposits considered income?

Explanation. For a company — whether it be a bank or a non-financial business — customer deposits are not income items and, therefore, do not go into taxable income calculation. … Non-bank accountants treat client deposits as unearned revenue, which is a short-term liability.

Are deposits assets or liabilities?

The deposit itself is a liability owed by the bank to the depositor. Bank deposits refer to this liability rather than to the actual funds that have been deposited. When someone opens a bank account and makes a cash deposit, he surrenders the legal title to the cash, and it becomes an asset of the bank.

What is a good golden rule?

First, the Golden Rule should say, “Do unto others as THEY want to be treated” rather than “how YOU want to be treated.” Otherwise, you’re imposing your preferences and values unto others. Second, be empathetic. Don’t assume you know what people need; you’re not a mind reader.

What are the 5 basic accounting principles?

What are the 5 basic principles of accounting?

- Revenue Recognition Principle. When you are recording information about your business, you need to consider the revenue recognition principle. …

- Cost Principle. …

- Matching Principle. …

- Full Disclosure Principle. …

- Objectivity Principle.

What are 3 types of accounts?

3 Different types of accounts in accounting are Real, Personal and Nominal Account.

Is interest expense a liability or asset?

Interest expense can be both a liability and an asset. Prepaid interest is recorded as a current asset while interest that hasn’t been paid yet is a current liability.

What is deferred tax liability?

IAS 12 defines a deferred tax liability as being the amount of income tax payable in future periods in respect of taxable temporary differences. So, in simple terms, deferred tax is tax that is payable in the future.

Is common stock an asset?

No, common stock is neither an asset nor a liability. Common stock is an equity.

Add comment