If the check is issued to two people, such as John and Jane Doe, the bank or credit union generally can require that the check be signed by both of them before it can be cashed or deposited. If the check is issued to John or Jane Doe, generally either person can cash or deposit the check.

Keeping this in consideration, Can you deposit a check into your account with someone else’s name?

Many banks in the US will allow you to deposit someone else’s check in your account – if the payee or the owner of the check has endorsed the check over to you. They will have to write something like “Pay to (your full name)” and then sign it on the back of the check.

Secondly Does the name on the check matter? Legally, there is no requirement that a check have the name of the maker, as long as the bank can identify the account. You may run into problems trying to use checks with merchants, when the name does not match that on your ID.

Can I deposit a check with my wife’s name on it?

Your bank will usually allow you to deposit your husband’s check into your account if you add your husband’s name to the account as a secondary user. … After completion, you can cash as many of your husband’s checks using the account as you like.

Table of Contents

Can I deposit my boyfriends check into my account?

You can deposit a check made out to someone else in your own bank account if the payee endorses the check over to you. They will need to write “Pay to <your name>” on the back of the check and sign it. There is, however, no legal requirement that the bank accept such checks.

Can I deposit my wifes check into my account?

Your bank will usually allow you to deposit your husband’s check into your account if you add your husband’s name to the account as a secondary user. … After completion, you can cash as many of your husband’s checks using the account as you like.

What happens if you deposit a check with a different name?

It’s called a third party check. Most banks will allow you to deposit it into your account if the back of the check is endorsed by the person the check is made out to. The bank will usually accept the check, but put a hold on it until they actually receive the money from the other bank.

How do I deposit a check Not in my name?

Some banks allow cheques to be cashed by someone other than the person named on the front of the cheque if it is counter-signed. For example, if John Smith writes a cheque to Jane Doe, she can endorse the cheque on the back and give it to you in payment of a debt.

Do banks look at signatures on checks?

Generally speaking, a teller will always check the signature of any check being cashed, as well as large checks that are being deposited. … There is, however, no legal requirement that the bank accept such checks. To verify a check, you need to contact the bank that the money is coming from.

What happens if you deposit a check without signing it?

Without a signature, the check might be sent back to the issuer, resulting in fees and delays in getting your money. Even if your bank deposits a check without a signature on the back and you see the money added to your account, that check might get rejected a week or two later.

Can I deposit my husband’s check into my chime account?

We understand the importance of sharing a bank account with a spouse or a dependent so we’re actively working on this feature. Ask the cashier to make a deposit directly to your Chime Spending Account. Can someone else deposit my check? Yes its possible.

Can you deposit a check without a signature?

No Endorsement

You don’t always have to endorse checks. Some banks allow you to deposit checks without a signature, account number, or anything else on the back. Skipping the endorsement can help keep your information private. … For extra security, you can still write “for deposit only” in the endorsement area.

Can I deposit my boyfriends check into my account Wells Fargo?

Hi Khalil: No. You are not able to deposit a check made payable to someone else, and deposit it into your own account. Wells Fargo has stopped taking third party checks. The person that the check is made payable to needs to be there with a valid ID.

How can I cash a check that’s not in my name?

This would be done by having the payee endorse the check (sign the back) and below that write “PAY TO THE ORDER OF JOHN SMITH“, and then John Smith can endorse and then cash or deposit the check.

Can I deposit a friends check in my account?

You can deposit a check made out to someone else in your own bank account if the payee endorses the check over to you. They will need to write “Pay to <your name>” on the back of the check and sign it. Normally yes but you have to sign as well as the person it’s wrote to.

Does a check need to be endorsed for deposit?

A check must be endorsed on the back for it to be valid for deposit. So, always sign your name in the blank space next to the X just before you bring it to the Bank. Note: You can deposit at a Bank location, through our mobile app, or at an ATM.

Can I deposit a check with a different name US bank?

Basically, when you deposit a check written to multiple payees, all payees must endorse the checks. Furthermore, all payees must go with you to your bank and present a government-issued ID. This is required to authenticate each payee’s signature. … U.S. Bank.

Can you deposit a check that is not signed?

A bank will not cash a check that is not endorsed, however, an individual can deposit a check into the payee’s account without signing the check. The signature line would need the words “For Deposit Only.”

Why should for deposit only be written on a check?

If you write “for deposit only” on the back of a check made out to you and then sign your name, the check can only be deposited in your account. This is called a “restrictive indorsement,” and it should prevent you or any other person from cashing the check.

Can someone deposit a check for me without my signature?

No Endorsement

Some banks allow you to deposit checks without a signature, account number, or anything else on the back. Skipping the endorsement can help keep your information private. … Technically that’s not an endorsement, but most banks and credit unions would be reluctant to cash that check for anyone.

Can I deposit my daughters check into my account?

If you plan to deposit the check into your own bank account, you’ll typically need to sign your child’s name on the back of the check followed by the word “minor” — and then endorse it with your signature right below the minor’s name.

What if I deposit a check that isn’t mine?

Yup, that too. Regardless, no bank is going to accept a check for deposit that isn’t made out to you. Doesn’t matter if you use an ATM machine. Once it goes through the process it will be rejected, the true owner informed, your identity confirmed, and you will be arrested.

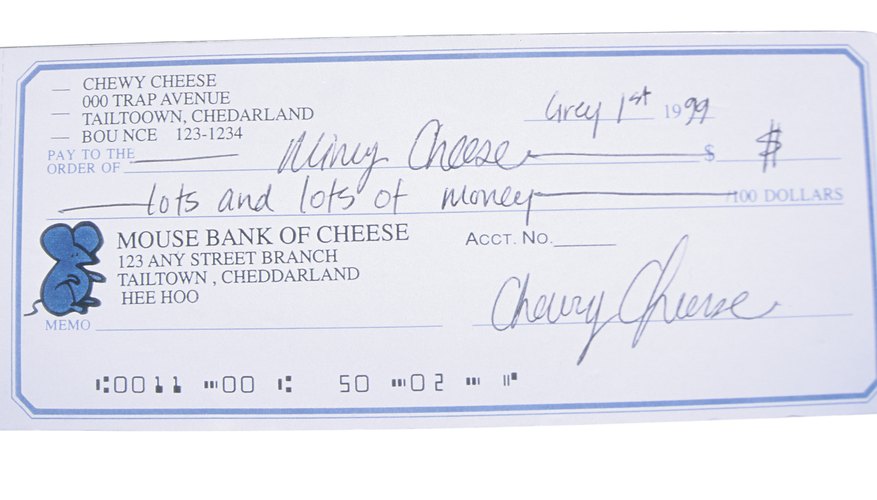

Why are there two signatures on a check?

By requiring two signatures, the company is verifying that both signers agree that the payment is proper and reasonable. The requirement of two signatures reduces the likelihood that one will write improper checks to themselves or writing checks to a fictitious company.

Do banks check signatures on checks?

In either event, banks will require signature cards so that they can verify signatures on checks presented for payment. Do not assume from a bank’s request for signature cards that it is checking signatures. Banks do not verify signatures.

Where do I sign a check without endorsement?

- Yes, simply sign on the backside of the check As you normally would on a check that contains an (X) in the top left corner with the words ”Endorse Here”.

- Utilize a rectangle you mentally construct.

How much of a check is available immediately bank of America?

Funds will generally be available the next business day. 8:00 p.m. PT for same-day credit. Funds will generally be available the next business day. You will be notified if a hold is placed on any deposited funds.

Add comment