No Income Tax on Gift Received from Relatives

Hence gift from father, mother, brother, sister, father-in-law, mother-in-law, brother-in-law, sister-in-law, etc. will not attract any income tax. Grand parents can give tax free gifts.

Keeping this in consideration, How can I be a good father in law?

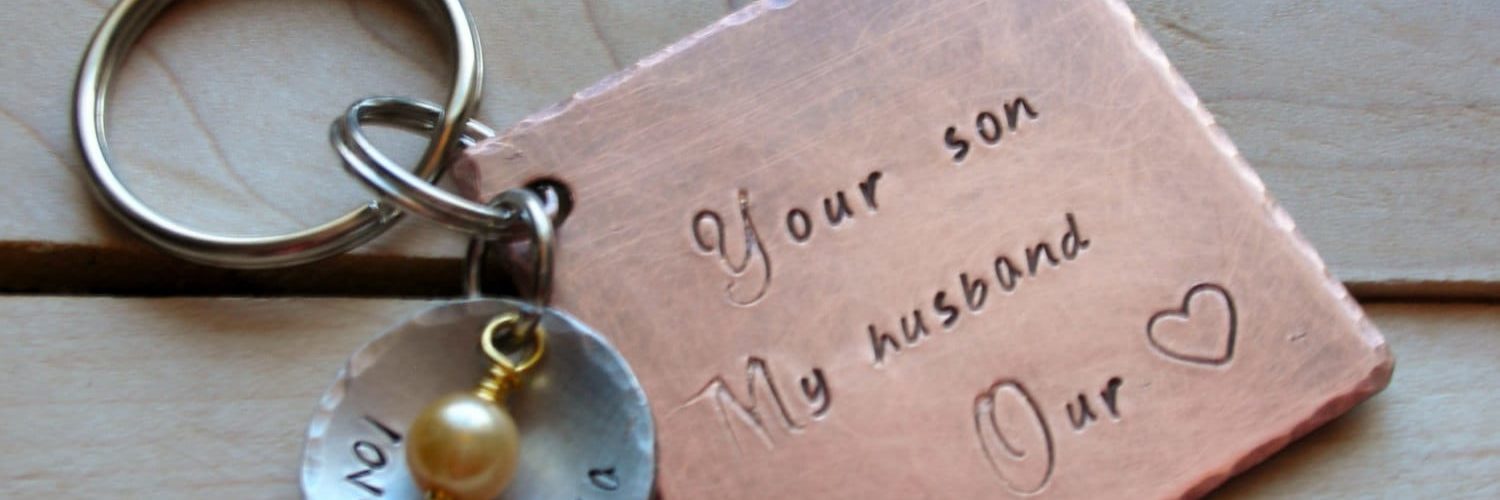

YOU ARE THE PERFECT FATHER-IN-LAW FOR ME!!!!!!!

…

- Cut the apron strings to your son. …

- Remember that your son has always had faults. …

- Compliment and encourage your daughter-in-law. …

- Keep your wife (the mother-in-law) in her place. …

- Accept your son and daughter-in-law’s goals and choices. …

- Be a servant. …

- Be a great grandparent.

Secondly Can father give gift to son-in-law? The simple answer is “NO”. Any gift in the form of articles, shares or cash are not taxable on your hand. If you want to understand the gift related income tax laws, Under section 56 of the Income-tax Act, any money received without consideration which is exceeding Rs. 50000 is taxable on your hand.

Can I gift my son-in-law money?

If a couple makes a gift from joint property, the IRS considers the gift to be given half from each. Mom and Dad can give $30,000 with no worries. A couple can also give an additional gift of up to $15,000 to each son-in-law or daughter-in-law.

Table of Contents

How do I ignore my father in law?

There are actually several ways to handle disrespectful in-laws.

- Show a United Front with Your Spouse.

- Conflict Engagement . . . or Not.

- Avoid Public Conflict and Drama.

- Set Rules and Boundaries With Your Spouse.

- Maintain a Sense of Humor.

- Don’t Whine or Play Victim.

- Getting Along on Special Occasions.

- Important Consideration.

What does a father in law do?

Fathers-in-law

A father-in-law is the father of a person’s spouse. Two men who are fathers-in-law to each other’s children may be called co-fathers-in-law, or, if there are grandchildren, co-grandfathers.

Can parents give money tax free?

For tax years 2020 and 2021, the annual gift tax exclusion stands at $15,000 ($30,000 for married couples filing jointly.) This means your parent can give $15,000 to you and any other person without triggering a tax.

Can my parents give me 50k?

You can gift up to $14,000 to any single individual in a year without have to report the gift on a gift tax return. If your gift is greater than $14,000 then you are required to file a Form 709 Gift Tax Return with the IRS.

Can father give money married daughter?

Your father in law is jointly funding for the purpose of buying a property by his daughter. This can be treated as gift by father to his daughter. The donee may pay the applicable gift tax.

Can I gift 100k to my son?

You can legally give your children £100,000 no problem. If you have not used up your £3,000 annual gift allowance, then technically £3,000 is immediately outside of your estate for inheritance tax purposes and £97,000 becomes what is known as a PET (a potentially exempt transfer).

What is the gift limit for 2020?

For both 2020 and 2021, the annual gift-tax exclusion is $15,000 per donor, per recipient. Thus a giver can give anyone else—such as a relative, friend or even a stranger—up to $15,000 in assets a year, free of federal gift taxes.

Can my parents give me 100k?

As of 2018, IRS tax law allows you to give up to $15,000 each year per person as a tax-free gift, regardless of how many people you gift. Lifetime Gift Tax Exclusion. … For example, if you give your daughter $100,000 to buy a house, $15,000 of that gift fulfills your annual per-person exclusion for her alone.

Why are in-laws so difficult?

While one could point to many reasons why in-law relationships are so notoriously difficult to manage, it really boils down to two primary issues: boundaries and expectations. … Unmet expectations strain all relationships, but the stakes are high in in-law relationships because they are stakeholders in your marriage.

How do you handle dominating in-laws?

Dealing with your dominating mother-in-law is very easy if only you know the tricks.

- Set your boundaries. You should definitely respect your mother-in-law. …

- Know your priorities. Your husband and children are your top priority. …

- Be emotionally detached. …

- Talk to her directly. …

- Talk to your husband.

How do you stay away from in-laws?

Consider distancing yourself instead.

- For instance, you might decide to limit your contact with your in-laws most of the time, but still see them at big family get-togethers. …

- Distancing yourself may be the simplest solution if you only see your in-laws once or twice a year.

What do you call your son’s father-in-law?

Filters. The father of one’s son- or daughter-in-law; that is, the father-in-law of one’s son or daughter, or, the father of one spouse in relation to the parents of the other spouse.

Why do mothers hate their daughters in law?

According to the parenting website Netmums, one in four daughters-in-law actually “despise” their mother-in-law finding her “controlling.” The site found that the daughter-in-law’s resentment stemmed from the mother-in-law thinking that she was the authority on parenting and parenting skills.

What is the difference between a father and a father-in-law?

Father in law is your spouse’s father, and step father is the person your mother remarries if she divorces your father.

Can I give my son 100000?

You can legally give your children £100,000 no problem. If you have not used up your £3,000 annual gift allowance, then technically £3,000 is immediately outside of your estate for inheritance tax purposes and £97,000 becomes what is known as a PET (a potentially exempt transfer).

Can I give 100k to my son?

As of 2018, IRS tax law allows you to give up to $15,000 each year per person as a tax-free gift, regardless of how many people you gift. Lifetime Gift Tax Exclusion. … For example, if you give your daughter $100,000 to buy a house, $15,000 of that gift fulfills your annual per-person exclusion for her alone.

How much money can I gift my son?

What are the rules on gifting money to children? You can gift money to your children in lump sums because every UK citizen has an annual tax-free gift allowance of £3,000. This enables you to give money to your children without worrying about inheritance tax.

How much money can parents gift a child?

In 2020 and 2021, you can give up to $15,000 to someone in a year and generally not have to deal with the IRS about it. If you give more than $15,000 in cash or assets (for example, stocks, land, a new car) in a year to any one person, you need to file a gift tax return. That doesn’t mean you have to pay a gift tax.

Can husband gift to wife?

There is no restriction on husband giving any money out of his income to his wife but you cannot claim any tax benefits in respect of money gifted to your wife. You will have to pay full tax on your income because gifting of money, out of your income, is treated as application of income.

What is the 7 year rule for gifts?

If you die within 7 years of gifting the asset, then the gift will count towards your nil-rate band, as we mentioned above, meaning that it may still be subject to IHT. After 7 years, the gift doesn’t count towards the overall value of your estate. This is known as the 7 year gift rule in inheritance tax.

Can I give my children money?

You can gift money to your children in lump sums because every UK citizen has an annual tax-free gift allowance of £3,000. This enables you to give money to your children without worrying about inheritance tax. … You’re allowed to gift smaller sums of money, up to £250 a year, to as many people as you want.

Add comment