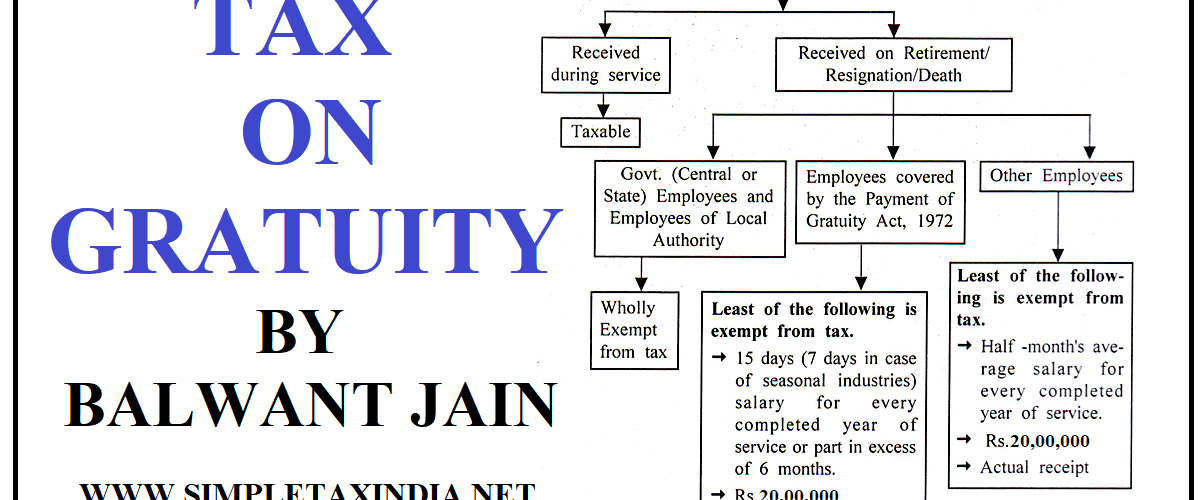

In the case of the former, the entire gratuity amount received on retirement or death is exempt from income tax. In the case of private employees, they are divided as: Private employees covered under the Payment of Gratuity Act of 1972. Private employees not covered under the Payment of Gratuity Act of 1972.

Keeping this in consideration, Is tax charged on gratuity?

An optional payment designated as a tip, gratuity, or service charge is not subject to tax. A mandatory payment designated as a tip, gratuity, or service charge is included in taxable gross receipts, even if the amount is later paid by the retailer to employees.

Secondly What is 26 gratuity calculation? For calculating the per day wage of the employee, the monthly wage (last drawn Basic + Dearness Allowance) is divided by 26 and the result is multiplied by 15 x the number of years of service; i.e. Gratuity = (Basic + DA) x 15/26 x number of years.

What is the new rule of gratuity?

In case of gratuity, for each year of service, the organization has to pay an amount equalling 15 days of last-drawn salary. Salary here is considered basic wages plus dearness allowance.

Table of Contents

Is gratuity and service charge the same?

A gratuity is also known as a tip. Example —We typically tip our waitress or our hair stylist for great service. So, what’s the difference — A service charge is mandatory and it is pre-determined by the hotel or vendor. The gratuity is at the discretion of the bride or groom.

Do you still tip if gratuity is added?

If an amount is included as a “Gratuity” or “Service Charge,” tipping is not required. … If the tip is included, the breakdown of the bill will read “gratuity” or “service charge,” which means that a tip is already included.

Is gratuity calculated on gross salary?

Gratuity payment is one of the several components that make up the gross salary of the employee. However, an employee is eligible to receive the gratuity amount only after they complete a period of 5 or more years with the company.

What is the formula for bonus calculation?

Calculation for Bonus Payable

Calculation of bonus will be as follows: If Salary is equal to or less than Rs. 7000/- then the bonus is calculated on the actual amount by using the formula: Bonus = Salary x 8.33/100.

What is gratuity percentage in salary?

Ans: An employee can receive a maximum of 57.69% of the monthly salary as gratuity. To know the exact amount of gratuity, you can use the Gratuity calculator.

What is the limit of gratuity?

The maximum amount of gratuity that can be paid to an employee is Rs 20 lakh. The employer can, however, pay more gratuity than the prescribed ceiling. The payment of gratuity is made either to the employee at the time of his retirement, or termination or to the legal heir in case of death of the employee.

Can I claim gratuity after 1 year?

Employees Can Soon Get Gratuity Within 1-3 Years, Instead Of 5 Years As Part Of Labor Reforms. Employees Can Soon Get Gratuity Within 1-3 Years, Instead Of 5 Years! As per existing labor laws, an employee is eligible to claim gratuity after 5 years of service in a company.

What is automatic service fee gratuity?

What Is Automatic Gratuity? Auto gratuity is when a restaurant automatically adds a gratuity charge to the bill of a party. Usually, this gratuity is equal to 18% of the bill and is only applied to parties of six or eight or more.

What is a gratuity fee?

A gratuity (normally called a tip) is a sum of money customarily given by a client or customer to certain service sector workers for the service they have performed, in addition to the basic price of the service.

Does service charge go to staff?

There are no laws about splitting tips and service charges, but the British Hospitality Association (BHA) has a code of practice. … It also says that discretionary service charges and non-cash tips are usually paid to employees with tax deducted, just like wages.

Can you refuse to pay automatic gratuity?

For example, some courts have found that automatic “tipping” is not enforceable. So if a patron chooses not to pay this tip, he can and the restaurant cannot go after him for theft charges. … Because of this, many restaurants instead call their auto-gratuity a “service charge,” typically reserved only for large groups.

What is the gratuity percentage?

In the US, a tip of 15% of the before tax meal price is typically expected.

Is 10 percent a good tip?

Tipping rules of thumb

Another guideline is to tip a waiter or waitress 15 percent for good service, 20 percent for exceptional service and no less than 10 percent for poor service.

Who pays gratuity?

Gratuity is a sum of money paid by an employer to an employee for services rendered in the company. However, gratuity is paid only to employees who complete 5 or more years with the company.

How is 15 and 26 gratuity calculated?

Gratuity is dependent upon the total number of years served in the company and the last drawn salary. Then, Gratuity = A*B*15/26 ; 15 being wages for 15 days and 26 being the days of the month.

What is DA in gratuity?

Calculation of gratuity covered under the payment of gratuity act. For the calculation of gratuity, salary includes only Basic salary and Dearness Allowance (DA). There won’t be any other components that will be considered for the calculation of gratuity here.

How is year end bonus calculated?

To calculate, divide the total bonus you want to distribute by the number of employees who will be receiving it. For example, assume the accounting department set a goal of lowering this year’s expenses by 2%. You decided that the department would earn a total of $5,000 for the year if the goal is met.

What is the rule of bonus payment?

The Payment of Bonus Act, 1965 provides for a minimum bonus of 8.33 percent of wages. The salary limited fixed for eligibility purposes is Rs. 3,500 per month and the payment is subject to the stipulation that the bonus payable to employees drawing wages or salary not exceeded to Rs.

How does excel calculate gratuity?

Formula To Calculate Gratuity

- Last Drawn Salary: Basic Salary + Dearness Allowance (DA)

- Total Years of Service: Number of years of service in a company. The mathematical rule of point will apply here in calculating the years.

- 15/26: 15 is wages for 15 days and 26 are the working days of the month.

How is gratuity deducted from salary?

After having served your employer for five years or more you become entitled to a payment called “gratuity”. … Companies usually deduct 4.81% of your basic plus dearness allowance towards gratuity payment. This 4.81% is computed as (15/26)/12. Effectively, it is half a month’s salary on a base of a year’s salary.”

What is the gratuity amount?

Gratuity Amount is equal to one-fourth of the last-drawn basic salary of an employee for each completed six-month period. The retirement gratuity amount which is payable is 16 times of the basic salary. However, it is subject to a cap of Rs. 20 lakh.

Add comment