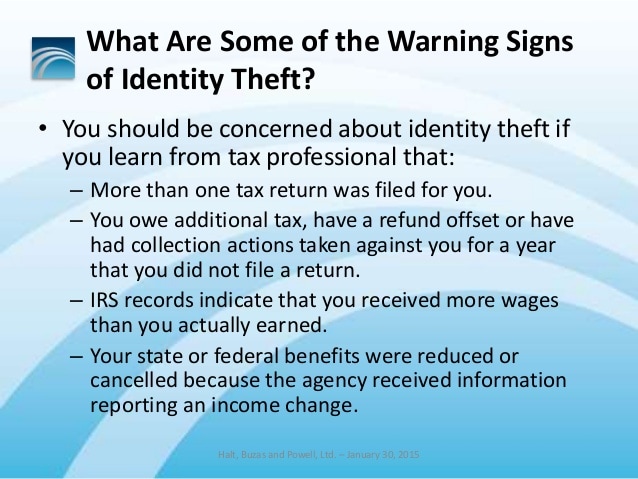

10 Warning Signs of Identity Theft

- An unfamiliar loan or credit account on your credit report. …

- An inexplicable denial of credit. …

- Bills for accounts you know nothing about. …

- An unexpected drop in your credit score. …

- Collections agency calls for overdue accounts you know nothing about.

Keeping this in consideration, How can I find out if someone opened a bank account in my name?

The best way to find out if someone has opened an account in your name is pulling your own credit reports to check. Note that you’ll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

Secondly How common is ID theft? Identity theft affects about 1 in 20 American each year. According to Javelin’s 2020 Identity Fraud Survey, 13 million consumers in the U.S. were affected by identity fraud in 2019 with total fraud losses of nearly $17 billion.

How long does it take to investigate identity theft?

On average, it can take 100 to 200 hours over six months to undo identity theft. The recovery process may involve working with the three major credit bureaus to request a fraud alert; reviewing your credit reports to pinpoint fraudulent activity; and reporting the theft.

Table of Contents

What can scammer do with my name and address?

With a name and address, a thief can change your address via U.S. Postal Service and redirect mail to their address of choice, Velasquez says. With access to your financial mail, the thief may intercept bank statements and credit card offers or bills, then order new checks and credit cards.

What is a ghost bank account?

The term “ghost account” or “ghost” (also known as a “sockpuppet” on other sites) is used to describe additional user accounts created or operated by an existing WP user, often used for the purposes of creating mischief or to bypass moderation penalties.

What is the most common form of identity theft?

Financial identity theft is by far the most common type of identity theft. In 2014, identity thieves stole $16 billion from 12.7 million identity fraud victims, according to Javelin Strategy & Research.

Who is most likely to be a victim of identity theft?

U.S. residents age 16 or older, were victims of one or more incidents of identity theft in 2014 (figure 1). This was similar to findings in 2012. Among identity theft victims, existing bank (38%) or credit card (42%) accounts were the most common types of misused information.

How much does the average person lose from identity theft?

Identity theft costs an average of $1,343 for victims who experienced a momentary loss.

Can you fully recover from identity theft?

On average, it can take between 100 and 200 hours and six months to fix. But in some cases, it can take thousands of hours and years to resolve fully. Several key factors determine the length of the recovery process, but before we review those, let’s look at the steps involved in resolving identity theft.

Does identity theft ruin your life?

Damaged credit: If an identity thief steals your Social Security number (SSN), opens new accounts in your name and never pays, it could ruin your credit history. Not only can this impact your ability to get credit, but it can also hurt your job prospects and increase your auto and homeowners insurance premiums.

What is the minimum sentence for identity theft?

A person convicted of misdemeanor identity theft faces up to one year in county jail, a fine of up to $1,000, or both. A person convicted of felony identity theft faces up to three years in California state prison, a fine of up to $10,000, or both. Federal law prohibits identity theft more severely than California law.

What can a scammer do with just my name?

With your personal information, scammers can:

- access and drain your bank account.

- open new bank accounts in your name and take out loans or lines of credit.

- take out phone plans and other contracts.

- purchase expensive goods in your name.

- steal your superannuation.

- gain access to your government online services.

What happens if you give personal information to a scammer?

Your SSN could be used to commit a crime by giving your number to law enforcers if they are caught. The scammer could use your SSN to get your tax refund. Your SSN could be used to claim medical benefits and this could taint your personal medical records.

How do you outsmart a romance scammer?

How To Avoid Losing Money to a Romance Scammer

- Stop communicating with the person immediately.

- Talk to someone you trust, and pay attention if your friends or family say they’re concerned about your new love interest.

- Do a search for the type of job the person has to see if other people have heard similar stories.

What is ghost transaction?

It’s called a ghost transaction, which basically means that the funds are set aside because somewhere between the company and the bank two authorisation codes were given. The company will have claimed for one and the other one should drop off your account in the next few days.

Can you hide a bank account?

Although many secret bank accounts hide a darker secret, some secret bank accounts are opened with lighter purposes. For example, you may want to save for a big gift or a special surprise without your partner knowing. In this case, a secret bank account will help to keep the surprise hidden.

What is a ghost Facebook account?

WHAT IS A FACEBOOK SHADOW PROFILE? A shadow profile is a collection of data that Facebook has collected about you that you didn’t provide yourself.

What is needed to steal my identity?

Identity theft begins when someone takes your personally identifiable information such as your name, Social Security Number, date of birth, your mother’s maiden name, and your address to use it, without your knowledge or permission, for their personal financial gain.

What are the 4 types of identity theft?

The four types of identity theft include medical, criminal, financial and child identity theft.

Which is the most common age group for victims of identity theft?

In 2020, the most targeted age group for identity theft were 30 to 39 year olds, among whom 306,090 cases were reported to the Federal Trade Commission (FTC) in the United States. The second most targeted age group were those aged 40 to 49, with 302,678 cases of identity theft reported.

What are four types of identity theft crimes?

The information is captured in a wide gamut of methods from sifting through someone’s trash to accessing databases. The four types of identity theft include medical, criminal, financial and child identity theft.

How does identity theft affect the victim?

For example, a study by the Identity Theft Resource Center found that 41% of identity theft victims experience sleep disturbances, and 29% develop other physical symptoms, including aches and pains, heart palpitations, sweating and stomach issues.

What is the punishment for identity theft from someone you know?

Identity theft in California can be charged as either a felony or a misdemeanor depending on (1) the defendant’s criminal history, and (2) the specific facts of the case. A person convicted of misdemeanor identity theft faces up to one year in county jail, a fine of up to $1,000, or both.

Is identity theft on the rise or is it declining?

There were 4.8 million identity theft and fraud reports received by the FTC in 2020, up 45 percent from 3.3 million in 2019, mostly due to the 113 percent increase in identity theft complaints. In 2020, 1.4 million complaints were for identity theft, up from 651,000 in 2019.

Add comment