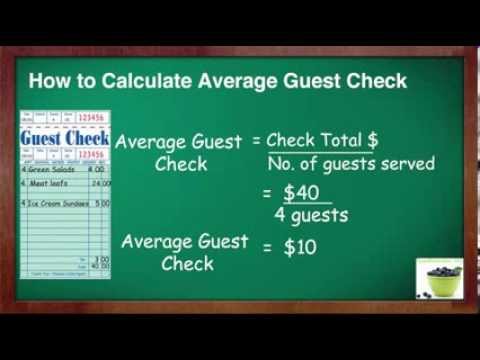

In a nutshell, the average check is the average transaction amount that is calculated by dividing the total number of sales by the total number of guests and can be measured daily, weekly, monthly, or year over year.

Keeping this in consideration, What is the formula for food cost?

To calculate your food cost percentage, first add the value of your beginning inventory and your purchases, and subtract the value of your ending inventory from the total. Finally, divide the result into your total food sales.

Secondly What is food cost percent? Food cost percentage is calculated by taking the cost of good sold and dividing that by the revenue or sales generated from that finished dish. Cost of goods sold is the amount of money you’ve spent on ingredients and inventory in a given time period – we’ll show you how to calculate that, too.

What is the formula to calculate cost?

Total Cost = Total Fixed Cost + Average Variable Cost Per Unit * Quantity of Units Produced

- Total Cost = $10,000 + $5 * $3,000.

- Total Cost = $25,000.

Table of Contents

What is the formula for food?

Food Cost Per Dish = Food Cost of Ingredients x Weekly Amount Sold. Total Sales Per Dish = Sales Price x Weekly Amount Sold.

How do you determine the selling price of a product?

To calculate your product selling price, use the formula:

- Selling price = cost price + profit margin.

- Average selling price = total revenue earned by a product ÷ number of products sold.

What is the selling price?

The term ‘selling price’ is defined as the price at which a good or service is sold by the seller to the buyer. … In other words, it is a market value or agreed exchange value that enables a buyer to purchase goods or services. It is also known as list price, quoted price, market price, or sale price.

What is the cost of 1 unit?

A unit cost is a total expenditure incurred by a company to produce, store, and sell one unit of a particular product or service. Unit costs are synonymous with cost of goods sold (COGS). This accounting measure includes all of the fixed and variable costs associated with the production of a good or service.

What is the price per unit?

The “unit price” tells you the cost per pound, quart, or other unit of weight or volume of a food package. It is usually posted on the shelf below the food. The shelf tag shows the total price (item price) and price per unit (unit price) for the food item.

What is the formula for cost per unit?

To calculate the cost per unit, add all of your fixed costs and all of your variable costs together and then divide this by the total amount of units you produced during that time period.

What is the prime cost?

A prime cost is the total direct costs of production, including raw materials and labor. Indirect costs, such as utilities, manager salaries, and delivery costs, are not included in prime costs. Businesses need to calculate the prime cost of each product manufactured to ensure they are generating a profit.

What is food cost report?

The cost of the raw materials that you use in preparing your menu items is your food cost. The Food Cost report helps you calculate what percentage those costs constitute of the total amount of revenues generated in your restaurant over a specified period.

What is the markup formula?

The markup formula is as follows: markup = 100 * profit / cost . We multiply by 100 because we express it as a percentage, not as a fraction (25% is the same as 0.25 or 1/4 or 20/80). This is a simple percent increase formula.

What is the formula for peso markup?

To calculate the markup amount, use the formula: markup = gross profit/wholesale cost.

How much should I markup my product?

While there is no set “ideal” markup percentage, most businesses set a 50 percent markup. Otherwise known as “keystone”, a 50 percent markup means you are charging a price that’s 50% higher than the cost of the good or service. Simply take the sales price minus the unit cost, and divide that number by the unit cost.

What is difference between MRP and selling price?

It is the price at which a product was made available to a retailer by the manufacturer. … The MOP is set by the manufacturer or the brand and is either lower than or equal to the selling price set by the retailer, who seeks to sell the product at above the MOP to make a profit. MRP is the maximum retail price.

Is it sale price or sell price?

While sales price is an “alternative term for price” according to Business Dictionary. In the retail industry we avoid this ambiguity – the common substitute is the selling price meaning the price it finally sells at.

What is meant by 1 unit?

1 Unit Electricity is the amount of electrical energy consumed by a load of 1 kW power rating in 1 hour. It is basically measurement unit of electrical energy consumption in Joule. 1 kWh (kilo watt hour) and 1 Unit are same. 1 kWh is the amount of energy consumption by 1 kW load in one hour. Therefore, 1 Unit = 1 kWh.

What are the charges of electricity per unit?

5.90) for the first 500 units of monthly consumption and Rs. 7.30 per unit (existing rate of Rs. 7.20) for consumption above 500 units. The industries in other ESCOMs’ limits will be charged Rs 5.70 per unit for the first 500 units and Rs 6.95 thereafter.

What is a 1 unit?

A unit is any measurement that there is 1 of. … So 1 meter is a unit. And 1 second is also a unit. And 1 m/s (one meter per second) is also a unit, because there is one of it.

What is the difference between unit price and selling price?

What is the difference between Unit Price and Unit Cost? Unit cost is the cost incurred on producing and packing a single piece of item, whereas unit price is the price of a single piece of item. Unit price is what is important from the customer’s point of view.

How do you increase unit price?

One additional way to increase the unit price of a product is to change both the retail price and the product size simultaneously and in the same direction but at disproportional rates.

How do you find the selling price?

To calculate your product selling price, use the formula:

- Selling price = cost price + profit margin.

- Average selling price = total revenue earned by a product ÷ number of products sold.

How do you calculate current bill?

How to Calculate Your Electric Bill

- Multiply the device’s wattage by the number of hours the appliance is used per day.

- Divide by 1000.

- Multiply by your kWh rate.

What is EOQ model?

Economic order quantity (EOQ) is the ideal order quantity a company should purchase to minimize inventory costs such as holding costs, shortage costs, and order costs. This production-scheduling model was developed in 1913 by Ford W. … 1 The formula assumes that demand, ordering, and holding costs all remain constant.

Add comment