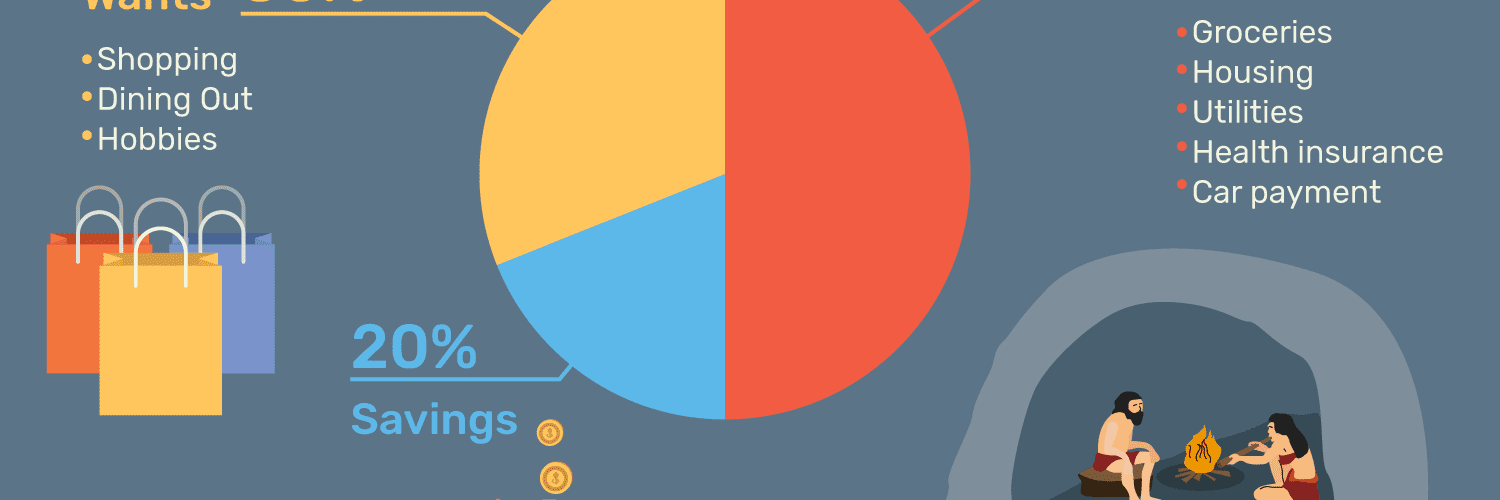

Senator Elizabeth Warren popularized the so-called “50/20/30 budget rule” (sometimes labeled “50-30-20”) in her book, All Your Worth: The Ultimate Lifetime Money Plan. The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.

Keeping this in consideration, How do I make a weekly budget?

Get a pen and paper or use a budgeting program, such as Mint, and tally all of your expenses over the past month. Divide all of these expenses into thematic categories, such as dining out, groceries, and gas. Then, total the amount spent over the month and divide it into four to get the weekly amount.

Secondly What is the 70 20 10 Rule money? Both 70-20-10 and 50-30-20 are elementary percentage breakdowns for spending, saving, and sharing money. Using the 70-20-10 rule, every month a person would spend only 70% of the money they earn, save 20%, and then they would donate 10%.

What is the 60 30 10 rule budget?

The 60/30/10 rule budget advocates saving 60% of your income, then dividing the rest between needs and wants. Saving and investing 60% of your budget could help you reach your dreams of retiring early and achieve financial independence.

Table of Contents

What is a normal weekly budget?

The average is about $300, says Friedman. Your discretionary spending will be tracked and you’ll get tips on Sunday evening about ways to curb your spending and stay under budget. You can do this on your own, too, by moving your weekly discretionary income on a prepaid debit card each week.

Is it better to budget weekly or monthly?

You’ll Be Better Prepared

If you plan a monthly budget, you might run out of funds sooner than you anticipated. By budgeting weekly, you’ll more closely track your expenses more closely, and identify just how much you spend on certain categories.

What is the 70/30 rule?

The 70% / 30% rule in finance helps many to spend, save and invest in the long run. The rule is simple – take your monthly take-home income and divide it by 70% for expenses, 20% savings, debt, and 10% charity or investment, retirement.

What is the 10 savings rule?

The 10% savings rule is a simple equation: your gross earnings divided by 10. Money saved can help build a retirement account, establish an emergency fund, or go toward a down payment on a mortgage. … Adjust your savings accordingly if faced with a low income or severe debt, but don’t give up entirely.

What are the 3 rules of money?

The three Golden Rules of money management

- Golden Rule #1: Don’t spend more than you make.

- Golden Rule #2: Always plan for the future.

- Golden Rule #3: Help your money grow.

- Your banker is one of your best sources of money management advice.

What is the 60 30 10 decorating rule?

What is the 60-30-10 Rule? It’s a classic decor rule that helps create a color palette for a space. It states that 60% of the room should be a dominant color, 30% should be the secondary color or texture and the last 10% should be an accent.

What is the 70/30 rule in finance?

The 70/30 Rule

Take your monthly take-home income and divide it by 70% and 30% and divvy up the percentages as so: 70% is for monthly expenses (anything spends money on) 10% goes into savings unless you have pressing debt in which case it goes toward debt first. 10% goes to investments, retirement, saving for college.

How do you budget for $1500 a month?

Here are 15 important tips and tricks for living on a budget of $1,500 or less each month:

- Make a Budget.

- Prioritize – Wise Up About How to Spend Money.

- Reduce Your Big Expenses.

- Examine and Cut Back Your Small Expenses.

- Have a Savings Account for Unexpected or Irregular Bills.

What is a good amount of spending money per month?

When it comes to how much you should spend, NerdWallet advocates the 50/30/20 budget. With this formula, you aim to devote 50% of your take-home pay to needs like rent and insurance, 30% to wants like gym memberships and vacations, and 20% to debt repayment and savings.

How much does the average person spend on gas a month 2020?

Average Transportation Costs in the U.S.

Nearly 90% of U.S. households report spending money on gasoline, an average of nearly $3,000 per year. The average cost of gas per month is $250.

How do I stop being broke?

Here are some action steps you can take to turn the tide.

- Live on Less Than You Make. Take a hard look at your take-home pay and outgo each month. …

- Increase Your Income. Look for side jobs you can pick up—dog walking, delivering pizza, freelancing. …

- Begin With the End in Mind. …

- Do the Math.

What is the Warren Buffett Rule?

The Buffett Rule is the basic principle that no household making over $1 million annually should pay a smaller share of their income in taxes than middle-class families pay. Warren Buffett has famously stated that he pays a lower tax rate than his secretary, but as this report documents this situation is not uncommon.

What’s the 7 day rule for expenses?

The 7 Day Rule is an effective strategy to avert impulse buying. The principle is mere. You simply give yourself a “cooling-off period”. Before making purchases above a certain amount, say $100, you give yourself 7 days to think it through.

What is the Buffett rule of investing?

One key rule is that Buffett believes investors should avoid going too far afield when buying stocks. Instead, he says investors should make sure they fully understand how a business operates, how it makes money, and the future sustainability of its business model and profits before buying its stock, per CNBC.

What is the 10 10 80 rule?

The 10-10-80 budget is built on the premise that a household requires no more than 80 percent of its earnings to live comfortably. Couples who subscribe to this budgeting plan set aside 80 percent of their combined paychecks for food, utilities, rent, clothing and other necessities.

What will 10000 be worth in 20 years?

How much will an investment of $10,000 be worth in the future? At the end of 20 years, your savings will have grown to $32,071. You will have earned in $22,071 in interest.

How much should you have in 401k to retire at 55?

Experts say to have at least seven times your salary saved at age 55. That means if you make $55,000 a year, you should have at least $385,000 saved for retirement. Keep in mind that life is unpredictable–economic factors, medical care, how long you live will also impact your retirement expenses.

What is the golden rule of finances?

The “Golden Rule” of government spending is a fiscal policy stating that a government should only increase borrowing in order to invest in projects that will pay off in the future. Under the Rule, existing obligations and expenditures are to be financed through taxation, and not issuing new sovereign debt.

What is the formula for wealth?

Wealth = Time × Money × Rate of return

This simple yet proven wealth formula can help you refocus your attention on what matters most for long-term investment success and help you stick to the investment plan you created with your advisor.

Is it worth it to hire interior designer?

So, many homeowners wonder if it’s financially viable or even wise to hire an interior designer. Do professional fees end up taking too large a percentage from the overall budget to make using an interior designer truly worthwhile? The answer is a resounding no.

What order do you decorate your house?

When decorating your first home, start with the bedroom . When decorating your first home, start with the bedroom.

…

Small Traditional Bedroom With Desk

- Clean house at the old place. …

- Start with the bedroom. …

- Don’t buy everything all at once.

What are the 7 elements of interior design?

What are the 7 elements of design? The 7 elements of design consider space, line, form, light, color, texture and pattern. A balance of these elements is vital to every scheme.

Add comment