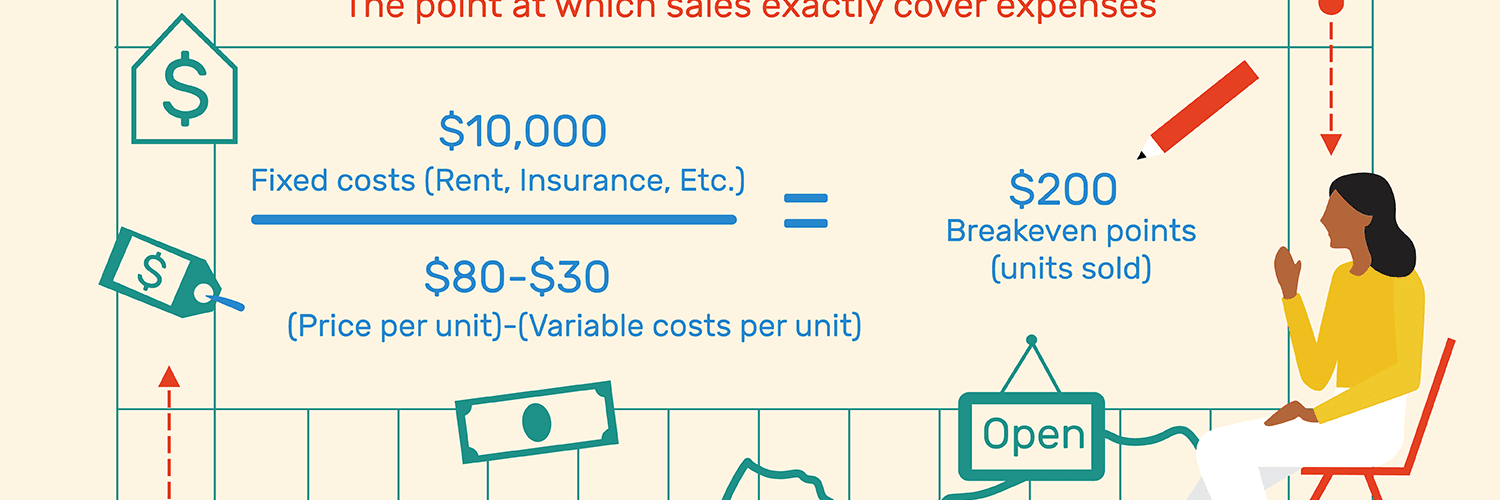

To calculate the break-even point in units use the formula: Break-Even point (units) = Fixed Costs ÷ (Sales price per unit – Variable costs per unit) or in sales dollars using the formula: Break-Even point (sales dollars) = Fixed Costs ÷ Contribution Margin.

Keeping this in consideration, What is the formula of food cost?

Here’s the COGS Formula for your convenience: Beginning Inventory + New Inventory Purchased – Ending Inventory = Total Food Usage in a particular period. Once you have the total amount used, you can find the Cost Of Goods Sold by : Toral Food Usage/Total Food Sales = COGS.

Secondly What is break-even point in simple words? The breakeven point is the level of production at which the costs of production equal the revenues for a product. In investing, the breakeven point is said to be achieved when the market price of an asset is the same as its original cost.

What is breakeven point example?

Break-even analysis is useful in studying the relation between the variable cost, fixed cost and revenue. Generally, a company with low fixed costs will have a low break-even point of sale. For example, a company has a fixed cost of Rs. 0 (zero) will automatically have broken even upon the first sale of its product.

Table of Contents

What is the formula for calculating labor cost?

Divide your restaurant’s labor cost by its annual revenue. For example, if the restaurant paid $300,000 a year to its employees and brought in $1,000,000 a year in sales, divide $300,000 by $1,000,000 to get 0.3. Multiply by 100. This final number is your restaurant’s labor cost percentage.

What should my food cost be?

What is a good food cost percentage? To run a profitable restaurant, most owners and operators keep food costs between 28 and 35% of revenue.

Why is it important to calculate break-even point?

Knowing the break-even point is helpful in deciding prices, setting sales budgets and preparing a business plan. The break-even point calculation is a useful tool to analyse critical profit drivers of your business including sales volume, average production costs and average sales price.

What is a good break-even percentage?

For example, if the optimal target for your strategy is 12 ticks, and the optimal stop-loss is 10 ticks, the break-even percentage is 45% (10 / (12+10)). This means that 45% of the trades that are taken must be winning trades for the trading system to break even.

What is the break-even price on an option?

In options trading, the break-even price is the price in the underlying asset at which investors can choose to exercise or dispose of the contract without incurring a loss.

Why is breakeven used?

Purpose. The main purpose of break-even analysis is to determine the minimum output that must be exceeded for a business to profit. It also is a rough indicator of the earnings impact of a marketing activity.

Why we use break even analysis?

Break-even analysis is widely used to determine the number of units the business needs to sell in order to avoid losses. This calculation requires the business to determine selling price, variable costs and fixed costs.

Which would not affect the break-even point?

Because the break-even point is determined by total cost, revenues do not directly affect the break-even point. … If revenues are less than total cost, a company does not reach the break-even point, which results in a loss.

How do you calculate fully loaded labor cost?

Employee’s Fully Burdened Labor Rate or total employee cost = (Labor Burden Costs PLUS gross payroll labor cost) DIVIDED BY the number of hours (production). * Remember, labor burden costs are those beyond gross compensation.

What is the ratio of materials to labor?

The cost of materials, project scope, and other requirements might also affect how much you should charge for labor. But according to The Construction Labor Market Analyzer, your construction labor cost percentage should be anywhere from 20 to 40% of total costs.

What is a good percentage of labor cost?

Most restaurants aim for labor cost percentage somewhere between 25%-35% of sales, but that goal may vary by restaurant industry segment: 25%: quick service restaurants with less specialized labor and faster customer transactions. 25-30%: casual dining, depending on the menu and methods of service.

What is average restaurant labor cost?

Most restaurants aim for labor cost percentage somewhere between 25%-35% of sales, but that goal may vary by restaurant industry segment: 25%: quick service restaurants with less specialized labor and faster customer transactions. 25-30%: casual dining, depending on the menu and methods of service.

What is the normal range in the percentage of food cost?

Answer: Typical food cost percentages run 20-40% of the overall operating cost of an establishment. Most sit-down restaurants are in the 30-35% range. Caterers and banquet operations, because of guest count guarantees and set menus, could have food costs in the 25-30% range.

What is food cost control?

Food cost controlFood cost control • It can be defined as guidance and regulation of cost of operations. • Under taking to guide and regulate cost needs to ensure that they are in accordance of the predetermined objectives of the business. •

How do you calculate profit from break-even point?

To calculate your break-even (units to sell) before net profit: Break-even (units) = overhead expenses ÷ (unit selling price − unit cost to produce)

How do you calculate fixed costs?

How to Calculate Fixed Cost

- Fixed costs = Total production costs — (Variable cost per unit * Number of units produced)

- $4,000 total production costs — ($3 * 1,000 tacos) = $1,000 fixed cost.

- Average fixed cost = Total fixed cost / Total number of units produced.

What are the limitation of break-even analysis?

Limitations. The Break-even analysis is only a supply-side (i.e., costs only) analysis, as it tells you nothing about what sales are actually likely to be for the product at these various prices. It assumes that fixed costs (FC) are constant.

Is break even good or bad?

Break even is basically a good thing. … Break even is good because your risk of going out of business because you’ve run out of cash is minimized. Since running out of cash is the number one cause of business failure, having certainty of no negative cash flow makes the investment much safer.

Is a higher or lower break-even point better?

A low breakeven point means that the business will start making a profit sooner, whereas a high breakeven point means more products or services need to be sold to reach that point. So, if your breakeven analysis reveals a high breakeven point, then you might want to consider: If any costs can be reduced.

What are the three methods to calculate break even?

Methods to Determine the Break-Even Point

- Contribution margin=Selling price−Variable expenses.

- Profit= P.

- Contribution Margin= CM.

- Quantity= Q.

- Fixed Expenses = F.

- Variable Expenses = V.

Add comment